-

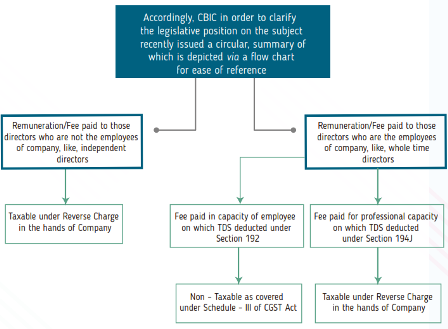

- Circular bearing no. 140/10/2020 – GST dated 10 June 2020 – clarifying the taxability of Director’s remuneration

A lot of debates were going on concerning the taxability of director’s remuneration under GST subsequent to a ruling pronounced by Rajasthan AAR in the matter of M/s Clay Craft India Pvt. Ltd. vide Order no. RAJ/AAR/2019-20/33 dated 20 February 2020 wherein it was ruled that salary paid to whole – time director is taxable under reverse charge. Earlier, Karnataka AAR in the matter of Alcon Consulting Engineers (India) P. Ltd. vide Order No. KAR ADRG 83/2019 dated 25 September 2019, also pronounced a similar ruling.

-

- Circular bearing no. 139/09/2020 – GST dated 10 June 2020 – clarification on refund related issues

Clarified that previous Circular No. 135/05/2020 – GST dated 31 March 2020 restricting the refund of accumulated ITC to the amount of ITC reflected in Form GSTR – 2A of assessee, is not applicable to the refund of ITC availed on the invoices / documents relating to imports, ISD invoices and the inward supplies liable to Reverse Charge (RCM supplies) etc. Therefore, in these specified cases, refund can also be sought for ITC availed in respect of invoices not reflected in FORM GSTR-2A.

-

- Notification bearing no. 47/2020 – Central Tax dated 09 June 2020 – Extension of E-way bill validity

Validity of all those e-way bills which were generated on or before 24 March 2020 has been extended till 30 June 2020. Therefore, all the E-way bills generated on or before 24 March 2020 are deemed to be valid till 30 June 2020 and no new E-way bill for such movement is required to be generated again.

-

- Notification bearing no. 46/2020 – Central Tax dated 09 June 2020 – Extension of time limit for issuance of orders relating to refund

Where SCN has been issued proposing to reject refund claim, in part or full, as per Section 54(7), time limit for issuance of such order by proper officer is 60 days from the date of receipt of complete refund application. This time limit for orders falling due between 20 March 2020 – 29 June 2020 has been extended to 15 days after receipt of reply to SCN from the assessee or 30 June 2020, whichever is later.

-

- Notification bearing no. 44/2020 – Central Tax dated 08 June 2020

Notified 08 June 2020 as the date on which provisions of Rule 67A shall come into force. Rule 67A provides furnishing of Nil return (FORM GSTR-3B) by registered persons through SMS facility using registered mobile number and verification shall be done by OTP.

-

- Amendments proposed in 40th GST Council Meeting held on 12 June 2020

Following amendments are proposed to be carried out, however, they shall be effective only through relevant notification/circular to be brought out.

- Late fee for non-furnishing FORM GSTR – 3B for the months of July 2017 to January 2020 having no tax liability is proposed to be waived off;

- Late fee for non-furnishing FORM GSTR – 3B for the months of July 2017 to January 2020 having tax liability is proposed to be reduced to a maximum cap of Rs. 500/return;

- For small taxpayers (aggregate turnover upto Rs. 5 crore), interest for late filing of return for the month of February, March and April 2020 beyond extended due dates, is proposed to be reduced to 9% instead of erstwhile 18%. This reduced interest rate of 9% is proposed to be reduced till 30 September 2020 and thereafter, rare of 18% to follow.

- For small taxpayers (aggregate turnover upto Rs. 5 crore), late fee and interest is proposed to be waived off if FORM GSTR-3B for the months of May, June and July, 2020 are furnished by September, 2020 (staggered dates to be notified).

-

For taxpayers whose GST registration has been cancelled till 12 June 2020 and time limit for revocation has been lapsed, an opportunity is proposed to be provided for filing of application of revocation up to 30 September 2020.