Article 16 – Case Scenarios

Mr. A & Mr. B are two partners in an Unincorporated Partnership in UAE having their distributive share as 70:30. The total income of the Unincorporated Partnership is AED 500,000.

Below mentioned are the details related to Mr. A:

- Expenditure incurred directly in conducting the Business of the Unincorporated Partnership of AED 50,000.

- Interest expenditure incurred in relation to contributions made to the capital account of the Unincorporated Partnership for AED 35,000.

- Interest received from the Unincorporated Partnership on their capital account of AED 80,000.

Calculate the Taxable Income of Mr. A.

Solution:

As per the provisions of Article 15; Partners in an Unincorporated Partnership shall be treated as individual Taxable Persons instead of the Partnership itself.

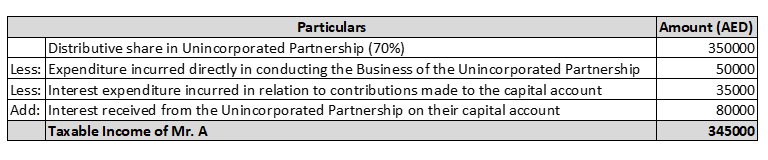

The taxable income of Mr. A will be as follows: