- Background:

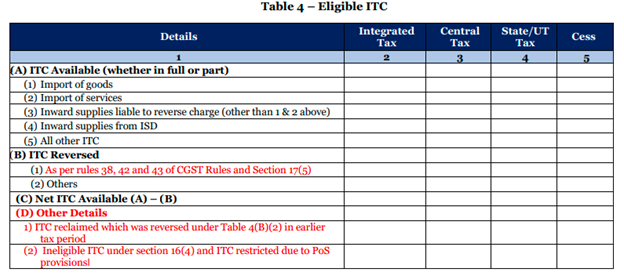

Earlier, the CBIC vide Notification No. 14/2022 – Central Tax dated 05 July 2022, notified few changes in Table 4 (Table 4(B)(1) and Table 4(D) were amended) of Form GSTR-3B, for enabling the taxpayers to correctly report information regarding reporting of Input Tax Credit (ITC) availment, ITC reversal, and Ineligible ITC.

- Pursuant to that, detailed Circular bearing No. 170/02/2022-GST dated 06 July 2023 was issued by the CBIC inter-alia, clarifying the manner for mandatory furnishing of correct and proper amount of ineligible/blocked ITC and reversal thereof in return in Form GSTR-3B.

[as hosted on https://gstcouncil.gov.in/sites/default/files/circulars/cir-170-02-2022-cgst.pdf].

- Subsequently, an advisory was issued and such notified changes of Table 4 of Form GSTR-3B were incorporated in Form GSTR-3B and were made available on GST common Portal from 01 September 2022 onwards. As a result of which, taxpayers were required to file Form GSTR-3B in line advisory issued by GSTIN.

- As per advisory issued by the GSTIN:

- All re-claimable ITC reversals shall be reported in entry (2) of table 4(B),

- ITC reversed under Table 4(B)(2) can be reclaimed in table 4(A)(5) at appropriate time, and

- If any ITC is re-claimed in any subsequent period return the break-up detail of such re-claimed ITC should be provided in 4(D)(1) in the same return.

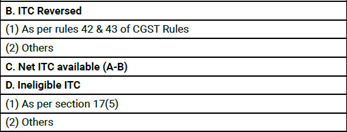

Earlier Table 4(B), (C) and (D) of Form GSTR-3B would read as under: –

Earlier Table 4(B), (C) and (D) of Form GSTR-3B would read as under: –

- Let us understand the changes in reporting patterns by way of an example: Let’s say, if certain ITC is appearing in Form GSTR-2B of a particular month, however, owing to some reason taxpayer is not availing such ITC in that particular month and taxpayer would avail such ITC it in a later month,

[for e.g., such supplies are not yet recorded in books of accounts or goods are not yet received against a particular invoice, or mismatch between books and Form GSTR-2B],

then in that case,

- Firstly, such ITC (as auto-populated) would be availed in Table 4(A)(5)- “All Other ITC”; and

- Then shall be reversed in Table 4(B)(2)- “Others”; and

- In a later month, when such ITC would accrue in books of accounts then, such ITC shall be re-claimed in Table 4(A)(5)- “All Other ITC”; and

- Further, such re-claimed ITC shall be reported in Table 4(D)(5) in the month it is re-claimed.

- Another instance, let’s say ITC needs to be reversed by the taxpayer as per Rule 37 of the CGST Rules 2017 (“the CGST Rules”), on account of non-payment of consideration along with taxes to supplier within 180 days of issuance of invoice, in such case,

- ITC against such supplies shall be reversed in Table 4(B)(2)- “Others”, and

- consequently, if payment is made by the recipient of goods/services in a subsequent month, then such ITC shall be re-claimed by the Recipient in Table 4(A)(5)- “All Other ITC” and

- such re-claimed ITC shall be reported in Table 4(D)(5) of Form GSTR-3B in the month it is re-claimed.

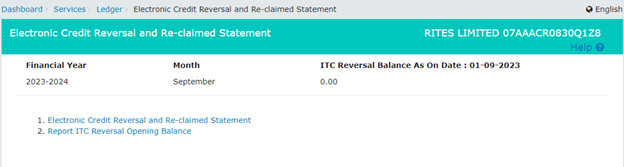

- Now, w.e.f. August 31, 2023, in order to further streamline the reporting of ITC, another facility has been brought into GST common portal, wherein taxpayers will have to report accumulated ITC reversal balances (made in the earlier periods) pending for re-claim.

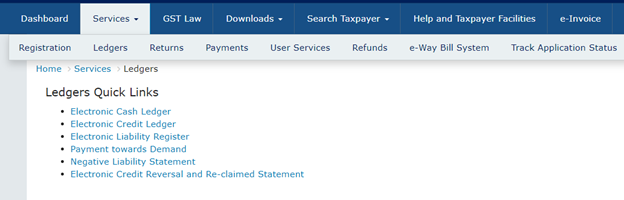

- Navigation on GST Common Portal:

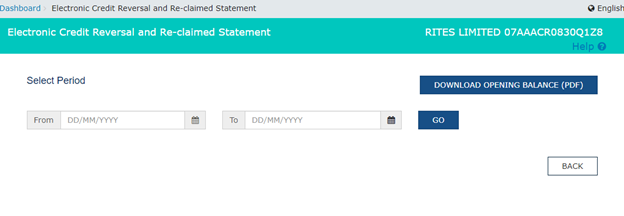

Services >> Ledger >> Electronic Credit Reversal and Re-claimed Statement >> Report ITC Reversal Opening Balance

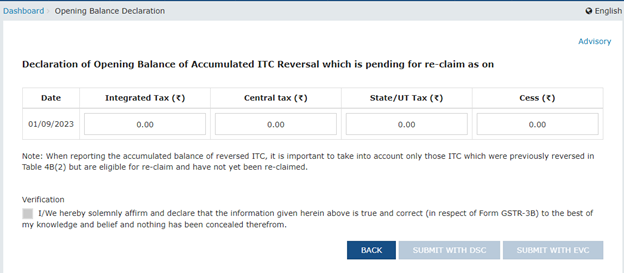

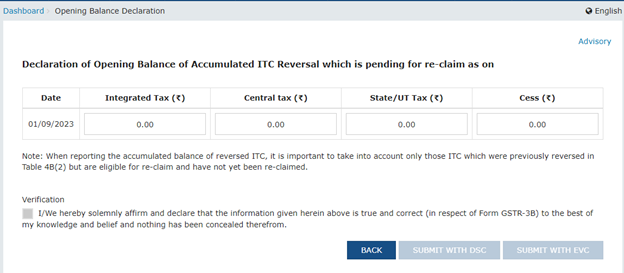

Declaration Page

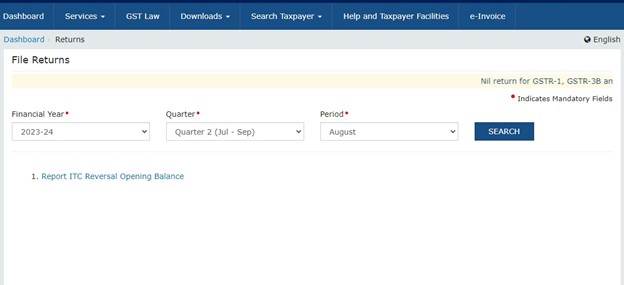

- Another Navigation on GST Common Portal:

Login >> Returns >> Returns Dashboard >>1. Report ITC Reversal Opening Balance.

- How the Portal will maintain a record of reversal and re-claimed amounts.

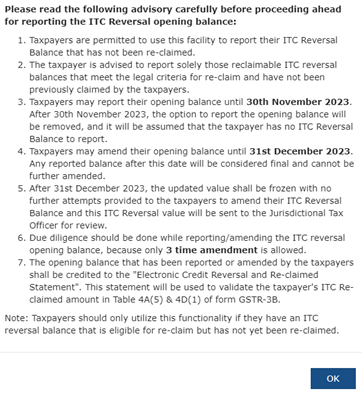

- Taxpayers will report their opening accumulated ITC reversal balances pending for re-claim, and

- Taxpayers shall have the opportunity to declare their opening balance for ITC reversal until 30 November 2023,

- Taxpayers shall also be provided 3 (three) amendment opportunities to correct their opening balance in case of any mistakes or inaccuracies in reporting until 31 December 2023.

- Importantly, until 30th November 2023, both reporting and amendment facilities are accessible.

- After 31 December 2023, the updated value shall be frozen with no further attempts provided to the taxpayers to amend their ITC Reversal Balance and this ITC Reversal value will be sent to the Jurisdictional Tax Officer for review.

- Date of opening balance would change, until this form is filed, and current date shall reflect whenever any taxpayer will open this facility.

below produced advisory will also pop up on GST Common Portal.

- Then, the GST Common portal will subsequently maintain a record of reversal and re-claimed amounts on a return period basis, and statements can be accessed as under

- This validation will trigger a warning message if a taxpayer attempts to re-claim excess ITC in Table 4D(1)-“ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax period” than the available ITC reversal balance in the statement along with ITC reversal made in current return period in Table 4B(2).

In simpler terms, if Rs.100 is reported by a taxpayer as the accumulated opening ITC reversal balance pending for re-claim, and ITC reversal amounting to Rs. 20 is reported by the taxpayer in its monthly return subsequent to filing opening balance statement, then maximum of Rs. 120 can be re-claimed by the taxpayer in its Form GSTR-3B, otherwise it will trigger a warning message.

Author’s Note:

Taxpayers need to carefully report the values in the opening balance statement and monthly returns, as Department will rely upon these values while issuing the ITC mismatch notices.\ going forward. Proper reporting will prevent issuance of such mechanical notices solely issued basis the differences in afore-said returns/statements, leading to further scrutiny of books and increased litigation thereupon.

Disclaimer

The views expressed herein are strictly of the author. The contents of this article are solely for knowledge sharing purposes and for the reader’s personal non-commercial use. It does not constitute professional advice or recommendation of the firm.