Article 38 – Case Scenarios

- M/s XYZ Ltd has two business divisions i.e. extractive business and tax consultancy services. Its profit/loss under different F.Y.’s is as under:

| F. Y. | Extractive Business | Tax Consultancy | Total |

| 2022-23 | AED 6,00,000 | AED (-) 50,000 | AED 5,50,000 |

| 2023-24 | AED 2,00,000 | AED 5,50,000 | AED 7,50,000 |

| 2024-25 | AED 10,00,000 | AED (-) 4,00,000 | AED 6,00,000 |

| 2025-26 | AED (-) 1,00,000 | AED 4,00,000 | AED 3,00,000 |

| 2026-27 | AED 4,00,000 | AED 4,00,000 | AED 8,00,000 |

Corporate Tax introduced in F.Y. 2023-24.

Calculate Tax Loss relief adjusted and carried forward for each F.Y.

Ans:

| F. Y. | Tax Loss Accrued | Tax Loss Adjusted | Tax Loss C/F | Remarks |

| 2022-23 | – | – | – | Before commencement of Corporate Tax |

| 2023-24 | – | – | – | |

| 2024-25 | AED 4,00,000 | – | AED 4,00,000 | |

| 2025-26 | – | AED 3,00,000 | AED 1,00,000 | 75% of AED 4,00,000 |

| 2026-27 | – | AED 1,00,000 | – |

In question supra, Whether M/s XYZ Ltd has the option to adjust only AED 2,00,000 loss in F.Y. 2025-26 and carry forward balance amount i.e. AED 2,00,000?

- M/s XYZ Ltd has two business divisions i.e. extractive business and tax consultancy services. Its profit/loss under different F.Y.’s is as under:

| F. Y. | Extractive Business | Tax Consultancy | Total |

| 2021-22 | AED 5,00,000 | AED 1,00,000 | AED 6,00,000 |

| 2022-23 | AED 6,00,000 | AED (-) 50,000 | AED 5,50,000 |

| 2023-24 | AED 9,00,000 | AED (-) 3,50,000 | AED 5,50,000 |

| 2024-25 | AED 3,00,000 | AED 4,00,000 | AED 7,00,000 |

| 2025-26 | AED (-) 1,00,000 | AED 5,00,000 | AED 4,00,000 |

Corporate Tax introduced in F.Y. 2023-24.

Calculate Tax Loss relief adjusted and carried forward for each F.Y.

Ans:

| F. Y. | Tax Accrued | Tax Loss Adjusted | Tax Loss C/F | Remarks |

| 2021-22 | – | – | – | |

| 2022-23 | – | – | – | Before commencement of Corporate Tax |

| 2023-24 | – | – | – | Before a person becomes Taxable |

| 2024-25 | – | – | – | |

| 2025-26 | – | – | – | Loss incurred from Exempted Activity |

Article 38

- Mr. X has incorporated two companies i.e. XYZ Ltd and ABC Ltd. 100% shareholding of both companies vest with Mr X. Profit and Loss of both companies is as under:

| F. Y. | XYZ Ltd | ABC Ltd |

| 2023-24 | AED 4,00,000 | AED 5,00,000 |

| 2024-25 | AED 5,00,000 | AED 4,00,000 |

| 2025-26 | AED (-) 4,00,000 | AED 1,00,000 |

| 2026-27 | AED 2,00,000 | AED 4,00,000 |

In F.Y. 2025-26, XYZ Ltd transferred AED (-) 1,00,000 to ABC Ltd.

Calculate Tax loss adjusted and tax loss carried forward of both companies.

Ans:

Tax Loss for XYZ Ltd:

F.Y. 2025-26: Tax Loss accrued AED 4,00,000

Less: Tax Loss transferred to ABC Ltd AED 1,00,000

Tax Loss C/F to F.Y. 2026-27 AED 3,00,000

Tax Loss adjusted in F.Y. 2026-27 AED 1,50,000

Tax Loss C/F to F.Y. 2027-28 AED 1,50,000

Tax Loss for ABC Ltd:

Tax Loss t/f from XYZ Ltd F.Y. 2025-26 AED 1,00,000

Tax adjusted AED 75,000

Tax Loss C/F to F.Y. 2026-27 AED 25,000

Tax Loss adjusted in F.Y. 2026-27 AED 25,000

Tax Loss C/F to F.Y. 2027-28 Nil

- Mr. X has incorporated two companies i.e. XYZ Ltd and ABC Ltd. 100% shareholding of both companies vest with Mr X. Profit and Loss of both companies is as under:

| F. Y. | XYZ Ltd | ABC Ltd |

| 2023-24 | AED 4,00,000 | AED 5,00,000 |

| 2024-25 | AED 5,00,000 | AED (-) 1,80,000 |

| 2025-26 | AED (-) 2,00,000 | AED 2,00,000 |

| 2026-27 | AED (-) 4,00,000 | AED 2,00,000 |

In F.Y. 2025-26, XYZ Ltd transferred AED (-) 1,00,000 to ABC Ltd.

Calculate Tax loss adjusted and tax loss carried forward for ABC Ltd.

Ans:

Tax Loss for ABC Ltd:

| Self-Tax Loss | Tax Loss Transferred | ||||||

| F. Y. | Accrued | Adjusted | C/F | Transferred | Adjusted | C/F | Total C/F |

| 2023-24 | – | – | – | – | – | – | – |

| 2024-25 | 1,80,000 | – | 1,80,000 | – | – | – | 1,80,000 |

| 2025-26 | – | 1,50,000 | 30,000 | 1,00,000 | – | 1,00,000 | 1,30,000 |

| 2026-27 | – | 30,000 | – | – | 1,00,000 | – | – |

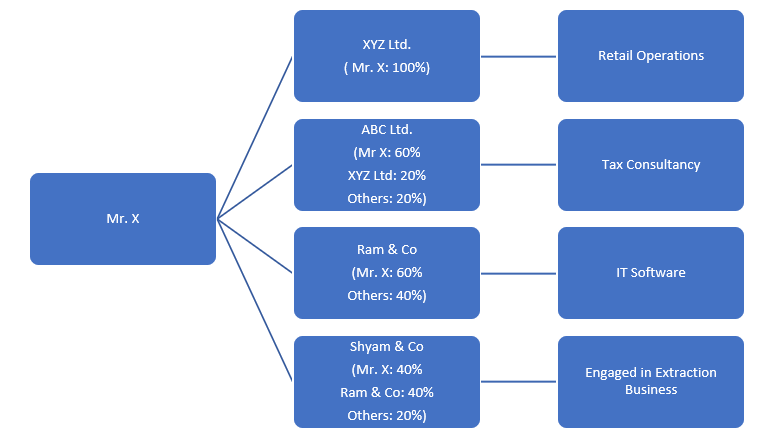

Mr. X has made investment in 4 companies. His investment details and nature of operations of each entity is as under:

Determine cases where transfer of tax loss is allowed.

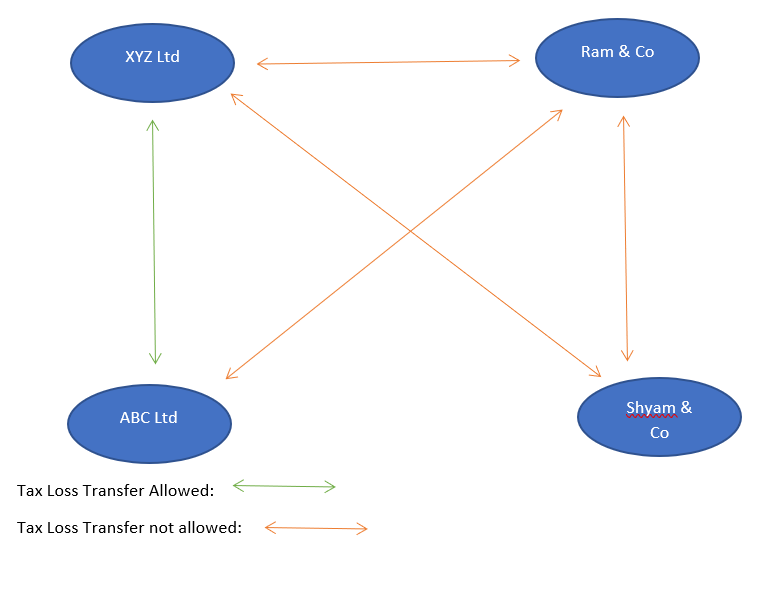

Ans:

Tax Loss Transfer Allowed:

Tax Loss Transfer not allowed: