VAT IN THE NETHERLANDS

1. Introduction

VAT in Dutch tax law is incorporated based upon EU Directives. This means that the principles and the structure of the tax are in general the same throughout the whole EU. Member states are however free to determine their domestic rates and turnover limits for registration.

1.1 What is Dutch VAT System?

Value added tax (VAT, in Dutch ‘BTW’) is levied in the Netherlands at each stage in the chain of production and distribution of goods and services. In its simplest form, a business will charge VAT (output tax) on its sales (supplies), and will be entitled to deduct the VAT (input tax) it has paid on its purchases. The business will then file a return at regular intervals with the tax administration and will deduct the input tax from the output tax and pay the balance. Where the input tax exceeds the output tax, the business will receive a refund.

1.2 Who is subject to Dutch VAT?

When you have permanent establishment, or you start up a business in the Netherlands or intend to supply goods or services to Dutch customers you will be confronted with the Dutch Vat. If you start up a business in the Netherlands, you are required to register for VAT purposes. The same can apply if you do not have a Dutch presence but you are supplying goods or services to Dutch customers. For instance, foreign company provides E-commerce services to the Dutch market.

1.3 What is a permanent establishment?

A permanent establishment is a business premises in the Netherlands that is equipped with sufficient facilities to operate as an independent business. The business premises are used for supplying goods or services to third parties.

Examples of a permanent establishment are:

– A shop or another fixed retail outlet – A Workshop or a production plant with an adjoining office.

Storage space, a goods depot or an establishment that is used only for supporting activities (such as performing research, advertising or distributing information) is not regarded as constituting a permanent establishment. A rented holiday home is not considered to be a permanent establishment either.

Example 1:

A German department store sells goods from a shop in the Netherlands. This shop is a permanent establishment because it operates as an independent business. The permanent establishment is a domestic company.

Example 2:

A Belgian manufacturer has a warehouse for raw materials in the Netherlands. This warehouse is not a permanent establishment because it does not operate as an independent business. The manufacturer is deemed to be a non-resident entrepreneur for the turnover tax.

2. Classification of companies as per Dutch VAT Legislation:

According to the Dutch VAT legislation there are two types of companies classified as Entrepreneur:

2.1 Operating Companies:

VAT entrepreneur is the person who deals in the goods and/or services which are taxable under VAT.

2.2 Holding Companies:

VAT entrepreneur is the company which is involved in financing & economic activities.

– Financing Activities: – When a holding company grant loan to its subsidiaries.

– Economic Activities: – The involvement of a holding company in the management of companies in which it has acquired a shareholding constitutes an economic activity where it entails carrying out transactions which are subject to VAT such as the supply by a holding company to its subsidiaries of administrative, financial, commercial and technical services.

3. VAT Entrepreneur: A taxable person who conducts an independent business, including natural persons, corporate bodies, partnerships, associations etc.

4. Dutch VAT tariffs:

There are 3 VAT Tariffs in the Netherlands

5. VAT Structure-

Followings are the taxable activities:

Supply of goods

Supply of Services

Purchase of goods

Purchase of Services

Distance Sale

6. Goods transactions:

There are various situations to be distinguished both with the purchase and sale of goods each with their own consequences for levying VAT.

6.1 Supply of Goods:

Supply of goods is the delivery or transfer of the power to dispose of the good as owner. In general, the supply of goods follows the sale of goods to a third party.

A supplier of goods may supply:

– To a buyer in the Netherlands;

– Intra-community;

– Export of goods.

6.1.1 Supply of goods within Netherlands:

When you supply goods to a buyer in the Netherlands and these goods remain in the Netherlands, then VAT has to be charged on the face of the invoice to purchaser and the purchaser can claim VAT Input through his VAT return. Except if the goods:

-Are used by purchaser for exempted services or supply of goods;

-Are used by him for his personal use.

However if VAT has to be charged on Reverse charge basis then supplier doesn’t need to charge the VAT on Invoice instead he needs to mention on the invoice “VAT Reverse-charged” as well as buyer’s VAT number.

6.1.2 Intra-Community supply of goods:

An intra-Community supply of goods is the supply of goods to a buyer in another EU country. Following 2 conditions need to be satisfied:

– Goods must be transported to another EU country;

– The buyer has to pay VAT on the intra-Community acquisition of the goods.

The transport to the other EU country has to be related to the supply of the goods. If these conditions have been met, this supply is taxed with 0% rate.

You may only apply the 0% rate if you can demonstrate that you actually supplied the goods to an entrepreneur in another EU country. In order to demonstrate this, you may use invoices in the name of the foreign buyers or receipts.

6.1.3 Supply of goods from NL to Non-EU:

Supply of goods from NL to Non-EU i.e. Export of goods are taxed at 0% VAT. It makes no difference whether the goods are supplied to a private individual or an entrepreneur. However you must be able to show from your administration that the goods have actually left the EU.

You may only apply the 0% rate if you can demonstrate by means of your accounts that the goods have actually been exported.

Export Declaration

If you export goods to non-EU countries, then you are required to complete an ‘export declaration’ for Customs. You can complete the export declaration yourself, but you can also arrange for a custom forwarding agent to submit the declaration.

6.2 Purchase/Acquisition of Goods:

When purchasing goods three situations may arise:

– Purchase of goods in the Netherlands;

– Intra-Community acquisition in the Netherlands (Purchase from EU to NL);

– Import of goods in the Netherlands.

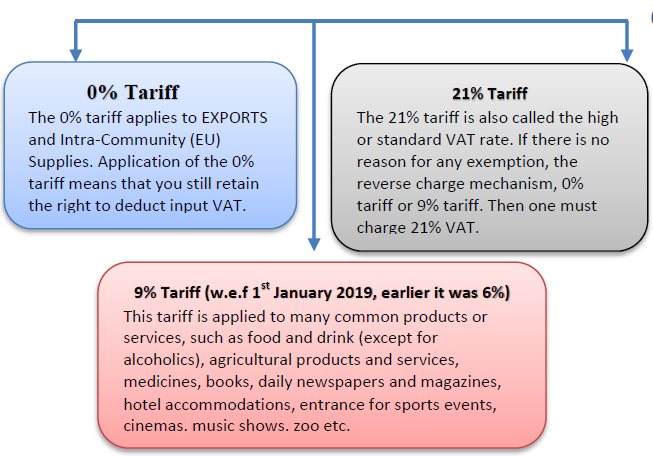

0% Tariff

The 0% tariff applies to EXPORTS and Intra-Community (EU) Supplies. Application of the 0% tariff means that you still retain the right to deduct input VAT. 9% Tariff (w.e.f 1st January 2019, earlier it was 6%)

This tariff is applied to many common products or services, such as food and drink (except for alcoholics), agricultural products and services, medicines, books, daily newspapers and magazines, hotel accommodations, entrance for sports events, cinemas, music shows, zoo etc.

21% Tariff

The 21% tariff is also called the high or standard VAT rate. If there is no reason for any exemption, the reverse charge mechanism, 0% tariff or 9% tariff. Then one must charge 21% VAT.

6.2.1 Purchase of goods in the Netherlands

If you purchase goods in the Netherlands and the goods remain in the Netherlands, the supplier (VAT registered) of the goods will charge you VAT. You may deduct this VAT as input tax on your return.

If you use the goods for purposes for which there is no entitlement to deduction, you may not deduct the VAT. The goods you purchased in the Netherlands may:

-Remain in the Netherlands;

-be transported to another EU country;

-leave the EU

6.2.2 Acquisition of goods from EU to NL (ICA)

If you purchase goods from an entrepreneur in another EU country, you may perform an intra-Community acquisition in the Netherlands.

This is the case, if you:

-acquire the goods based on a supply

-purchase the goods from an entrepreneur

-transport the goods or have them transported from the other EU country to the Netherlands

Transferring your own goods

You also perform an intra-Community acquisition if you transfer goods from your enterprise in another EU country to the Netherlands. In that case too, you register in the Netherlands and file a return in the Netherlands.

6.2.3 Acquisition of goods from Non-EU to NL (Import)

Goods entering the Netherlands from outside the EU have to be reported to Customs. You then have to submit a customs declaration for free circulation in the EU. The import of the goods is taxed with VAT and you have to pay this VAT upon import. If you file a VAT return you deduct this VAT as input tax. If you do not file a VAT return you may claim VAT back from the Belastingdienst.

Fiscal representative:

A person with special power of attorney who acts on behalf of non-resident entrepreneurs is what is referred to as a ‘fiscal representative’. If you wish to apply the reverse-charge mechanism upon import, you will have to engage the services of a fiscal representative in any case. If you engage the services of a fiscal representative, he will take care of the VAT return as well as the declaration of intra-Community supplies on your behalf. In addition, he will be able to apply the reverse-charge mechanism upon import on your behalf provided a permit has been requested for that purpose. Moreover, when you engage the services of a fiscal representative turnover tax in the Netherlands you will not have to register as a person liable for VAT if you are not developing any other VAT activities in the Netherlands.

Article 23 (VAT Deferment License):

The Netherlands have implemented a unique system based on article 23 of the Dutch VAT Act i.e. article 23 license. This license enables importers to avoid immediate payment of VAT upon importation of goods. Based on this system the VAT liability is shifted to the periodic VAT return. This means that import VAT needs to be declared in this periodic VAT return, but on the other hand can be deducted in the same return as well (assuming there is entitlement to a full VAT deduction). As a result, there is no actual payment of VAT upon import and thus a cash‐ flow and interest advantage.

Following conditions should be fulfilled for the application of the VAT deferment license:

The applicant must be resident OR have a permanent establishment OR have engaged the services of a fiscal representative in the Netherlands;

-The applicant must import goods on a regular basis; and

-The applicant must keep clear administrative records of the imported goods.

7. Services transactions:

Services refer to all activities, other than the supply of goods, conducted in the course of trade.

If you perform services, you only have to pay VAT if you meet the following two conditions:

-The service is performed in the Netherlands;

-The VAT due is not levied on the buyer i.e. Not a case of RCM.

7.1 Supply of services within Netherlands:

If services (other than exempted services) are supplied by a tax registered person in the Netherlands to a Dutch company or legal entity

With its registered office in the Netherlands, then supplier is required to charge Dutch VAT on the

face of the invoice. The receiver of service will take input of the same.

7.2 Supply of services from Netherlands to EU (ICS):

When services are supplied from the Netherlands to entrepreneurs in other EU countries, this is called as Intra-Community Supply. These supplies are taxed at 0% VAT. This represents an intra-Community acquisition for the receiver of the services in the EU country for which services have been performed.

Following conditions need to be satisfied for ICS:

-Must be able to prove from your administration that services have actually been provided in other EU country.

-Recipient of service is a VAT entrepreneur in the country to which the services have been supplied.

There can be two case of supply:

B2B supply of Services: The supply of services between businesses (i.e. service provider as well as the service receiver are VAT registered) is in principle taxed at the service receiver’s place of establishment.

B2C supply of Services: The supply of services by Netherlands supplier to private individuals (i.e. not VAT registered) are taxed at the supplier’s place of establishment.

7.3 Supply of services from NL to Non-EU (Export):

Export of Services is out of scope from Dutch VAT legislative.

7.4 Supplying or providing services exempt from VAT

A number of supplies and services are exempt from VAT. You will not have to pay VAT on these supplies or services but you will not be entitled to a deduction of input tax or a refund.

The following are some of the goods and services which are exempt from VAT:

-educational services

-certain services in the medical sector performed by recognized medical, professions and institutions

-certain socio-cultural services financial services

-services rendered by composers, writers and journalists

7.5 Acquisition of services in Netherlands:

Services are only taxed with Dutch VAT if they are performed in the Netherlands. Special rules apply to determine where the location of the service is. The rules are the same in all EU countries.

The basic rule is that services are pperformed at the place where the supplier is either resident or established. However certain exceptions are also to this basic rule.

Reverse charge Mechanism: If services are performed in the Netherlands by non-resident entrepreneur then he needs to report to the Dutch Tax and Customs Administration and need to declare the reverse-charged VAT in his VAT return. VAT has to be reverse charged if services are performed in the Netherlands and the buyer of the service:

-is an entrepreneur based in the Netherlands or has a permanent establishment in the Netherlands and is a legal entity established in the Netherlands.

8. Other Concepts in Dutch VAT

8.1 Distance sales:

If supplier is based in another EU country and he sells goods to private individuals and to entrepreneurs without VAT identification number in the Netherlands and goods are delivered to your buyer.

If the total amount of these supplies does not exceed the threshold limit i.e. € 100,000 he needs to pay the VAT in his own EU country.

However, if the total amount of these supplies exceeds the limit of € 100,000 then the supplier based in other EU country would be liable to pay VAT in the Netherlands and for this supplier is require to register with the Belastingdienst.

The limit of €100,000 does not apply to Excisable goods. Supplier may also choose to pay Dutch VAT on all your distance sales in the Netherlands, even if you do not exceed the threshold amount. You can make a request to this effect in your own EU country.

The distance sales regulation also applies in the reverse situation in which an entrepreneur sells goods from the Netherlands to private individuals in other member states of the EU.

If in a certain year you exceed the threshold of € 100,000, the following year there will be no threshold amount. The next year you will have to pay VAT in the Netherlands on all your distance sales.

8.2 A-B-C Supply chain transactions within the EU

An A-B-C supply chain transaction always concerns at least 3 business operators from one or more countries. In such a transaction, business operator A sells to B and B successively sells on to C. A delivers the goods directly to C. In such type of transactions, question arise in mind is that who pays the VAT & where it need to be paid?

It classified into two categories:

i) Standard A-B-C supply

ii) Simplified A-B-C supply

i) Standard A-B-C supply:

In a standard A-B-C supply chain transaction, the business operator A sells to B and B sells to C. The goods go directly from A to C. If the transport occurs within the framework of the supply (A-B), B (Middleman) must register in the country of C and he must submit the VAT return there.

Example: The oil company A in Netherlands sells a consignment of crude oil to the oil company B in Hamburg, and the latter company in turn sells it to an oil merchant C in Italy. The oil company B has provided instructions to A to take the goods straight to C in Italy. The transport to Italy, therefore, forms part of the transaction from A to B.

1. The first supply – The first supply from A to B, following treatment will be done by company A & B

– Company A will report ICS in Netherlands and sends an invoice to B with 0% VAT on which Italian VAT no (as B has to take registration in Italy) of company B will have to be mention.

– Company B will neither report any ICA nor ICS in Hamburg. He will have to be registered in the country of C (i.e. Italy) for VAT purposes and report ICA there to company A.

2. The second supply – The second supply (from B to C) is a domestic sale in Italy between two business operators. B therefore charges C with the Italian VAT. Company B will raise invoice to company C for a local sale (as B have to registered in Italy) and collect Italian VAT on its sale invoice to company C based on which company C can take Input credit of VAT paid in his country.

ii) Simplified A-B-C supply:

In a simplified A-B-C supply chain transaction, the business operator A sells to B and B sells to C. The goods go directly from A to C but there is no necessity for B to register and submit VAT return in the country of C.

In case of simplified A-B-C, the advantage to middleman i.e. company B is that there is no need for him to register in the country of C. If B is already registered in country C then he may not apply the arrangement of the simplified A-B-C supply chain transaction.

Following conditions need to be fulfilled to apply the simplified A-B-C supply chain transaction:

– You must be able to provide evidence of having bought the goods from A with the aim of successively selling them to C. You may provide such evidence by submitting a contract or an offer;

– There are 3 business operators who each have a VAT identification number in a different EU country;

– You make an arrangement with A in respect of the transport of the goods.

– The goods go directly from A to C in the country of C.

– You are not registered in the country of C.

– You already have to submit your VAT returns in the Netherlands in respect of other taxable activities.

– You include your intra-Community supply to C in your VAT return and in your intra-Community transactions declaration.