Notices under GST are communications issued by the GST authorities to registered person for specific purposes or actions required. Such notices can be referred to by different names, such as Scrutiny Notice, Show Cause Notice (SCN) or Demand Notice.

Scrutiny of returns – Section 61 of the CGST Act, 2017, read with Rule 99 of the CGST Rules, 2017.

Section 61

- The proper officer may scrutinize the return and related particulars furnished by the registered person to verify the correctness of the return and inform him of the discrepancies noticed, if any, in such manner as may be prescribedand seek his explanation thereto.

- In case the explanation is found acceptable, the registered person shall be informed accordingly and no further action shall be taken in this regard.

- In case no satisfactory explanation is furnished within a period of thirty days of being informed by the proper officer or such further period as may be permitted by him or where the registered person, after accepting the discrepancies, fails to take the corrective measure in his return for the month in which the discrepancy is accepted, the proper officer may initiate appropriate action including those undersection 65 or section 66 or section 67, or proceed to determine the tax and other dues under section 73 or section 74.

Rule 99

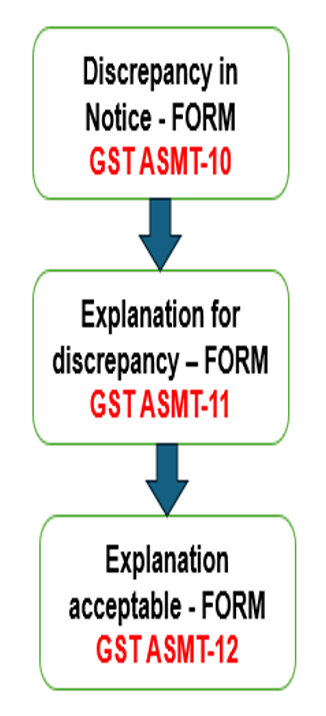

- Where any return furnished by a registered person is selected for scrutiny, the proper officer shall scrutinize the same in accordance with the provisions of section 61with reference to the information available with him, and in case of any discrepancy, he shall issue a notice to the said person in FORM GST ASMT-10 , informing him of such discrepancy and seeking his explanation thereto within such time, not exceeding thirty days from the date of service of the notice or such further period as may be permitted by him and also, where possible, quantifying the amount of tax, interest and any other amount payable in relation to such discrepancy.

- The registered person may accept the discrepancy mentioned in the notice issued under sub-rule (1), and pay the tax, interest and any other amount arising from such discrepancy and inform the same or furnish an explanation for the discrepancy in FORM GST ASMT-11to the proper officer.

- Where the explanation furnished by the registered person or the information submitted under sub-rule (2) is found to be acceptable, the proper officer shall inform him accordingly in FORM GST ASMT-12.

The notice in Form GST ASMT-10 can be issued for various reasons, including:

- Mismatch in details reported between GSTR-1 and GSTR-3B.

- Mismatch declaration in GSTR-1 and E-way bill portal.

- Mismatch of ITC claims found between GSTR-3B & GSTR-2A/2B.

- Non-payment/ Short payment of GST liability.

- Wrong availment of ITC/ Refund wrongly claimed.

- Additional Turnover declared in GSTR-9 but Tax not paid through DRC-03.

The intention of the law can be clearly inferred from the aforementioned provisions and rules. It is stipulated that following scrutiny of the returns, any discrepancies must be communicated to the taxpayer using Form ASMT 10. If the registered person fails to provide a satisfactory explanation or neglects to pay the tax after acknowledging the discrepancies, then only the proper officer may proceed to invoke Section 73 or Section 74 of the CGST Act, 2017.

Proceedings U/s 73 (Bonafide cases)

Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for any reason other than fraud or any willful-misstatement or suppression of facts.

Proceedings U/s 74 (Malafide cases)

Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised by reason of fraud or any willful- misstatement or suppression of facts.

Rule 142. Notice and order for demand of amounts payable under the Act

(1) The proper officer shall serve, along with the

(a) Notice issued under section 52 or section 73 or section 74 or section 76 or section 122 or section 123 or section 124 or section 125 or section 127 or section 129 or section 130, a summary thereof electronically in FORM GST DRC-01 ,

(b) statement under sub-section (3) of section 73 or sub-section (3) of section 74, a summary thereof electronically in FORM GST DRC-02 , specifying therein the details of the amount payable.

(1A) The proper officer may, before service of Notice to the person chargeable with tax, interest and penalty, under sub-section (1) of Section 73 or sub-section (1) of Section 74, as the case may be, communicate the details of any tax, interest and penalty as ascertained by the said officer, in Part A of FORM GST DRC-01A.

(2) Where, before the service of Notice or statement, the person chargeable with tax makes payment of the tax and interest in accordance with the provisions of sub-section (5) of section 73 or, as the case may be, tax, interest and penalty in accordance with the provisions of subsection (5) of section 74, or where any person makes payment of tax, interest, penalty or any other amount due in accordance with the provisions of the Act whether on his own ascertainment or, as communicated by the proper officer under sub-rule (1A), he shall inform the proper officer of such payment in FORM GST DRC-03 and the proper officer shall issue an acknowledgement, accepting the payment made by the said person in FORM GST DRC-04 .

(2A) Where the person referred to in sub-rule (1A) has made partial payment of the amount communicated to him or desires to file any submissions against the proposed liability, he may make such submission in Part B of FORM GST DRC-01A.

(3) Where the person chargeable with tax makes payment of tax and interest under sub-section (8) of section 73 or, as the case may be, tax, interest and penalty under sub-section (8) of section 74 within thirty days of the service of a Notice under sub-rule (1), or where the person concerned makes payment of the amount referred to in sub-section (1) of section 129 within seven days of the notice issued under sub-section (3) of Section 129 but before the issuance of order under the said sub-section (3), he shall intimate the proper officer of such payment in FORM GST DRC-03 and the proper officer shall issue an order in FORM GST DRC-05 concluding the proceedings in respect of the said Notice.

(4) The representation referred to in sub-section (9) of section 73 or sub-section (9) of section 74 or sub-section (3) of section 76 or the reply to any Notice issued under any section whose summary has been uploaded electronically in FORM GST DRC-01 under sub-rule (1) shall be furnished in FORM GST DRC-06 .

(5) A summary of the order issued under section 52 or section 62 or section 63 or section 64 or section 73 or section 74 or section 75 or section 76 or section 122 or section 123 or section 124 or section 125 or section 127 or section 129 or section 130 shall be uploaded electronically in FORM GST DRC-07, specifying therein the amount of tax, interest and penalty, as the case may be, payable by the person concerned.

(6) The order referred to in sub-rule (5) shall be treated as the Notice for recovery.

(7) Where a rectification of the order has been passed in accordance with the provisions of section 161 or where an order uploaded on the system has been withdrawn, a summary of the rectification order or of the withdrawal order shall be uploaded electronically by the proper officer in FORM GST DRC-08.