GST on Old Age Homes and Services for Senior Citizens

In this regard first we would like to highlight the following rules and provisions under GST laws as follows:

Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 – Exemption.

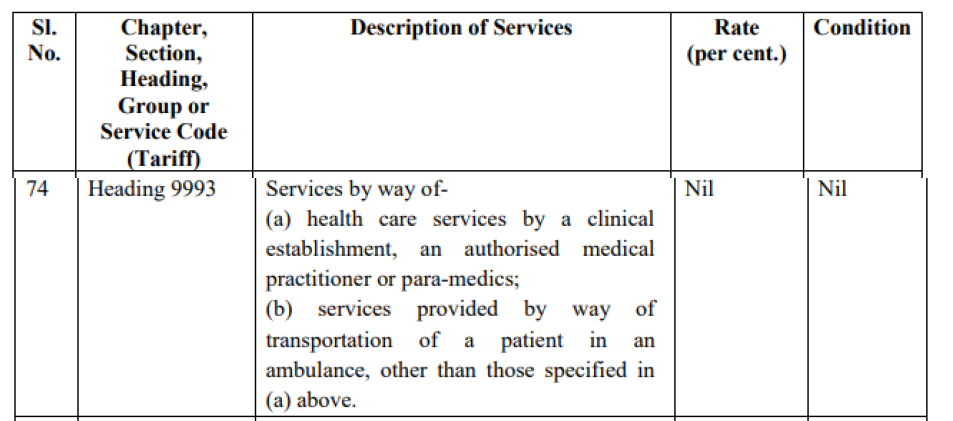

According to Serial number 74 of Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 as amended from time to time, exempts services by way of health care services by a clinical establishment, an authorized medical practitioner or para-medics. The said entry reads as follows:

The expressions “healthcare services”, “clinical establishment” and “authorised medical practitioner” have been defined in Para 2 (zg), 2(s) and 2(k) respectively of Notification No. 12/2017 Central Tax (Rate) dated 28.06.2017 as follows:

“health care services” means any service by way of diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognised system of medicines in India and includes services by way of transportation of the patient to and from a clinical

establishment, but does not include hair transplant or cosmetic or plastic surgery, except when undertaken to restore or to reconstruct anatomy or functions of body affected due to congenital defects, developmental abnormalities, injury or trauma;

“Clinical establishment” means a hospital, nursing home, clinic, sanatorium or any other institution by, whatever name called, that offers services or facilities requiring diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognised system of medicines in India, or a place established as an independent entity or a part of an establishment to carry out diagnostic or investigative services of diseases;

“Clinical establishment” means a hospital, nursing home, clinic, sanatorium or any other institution by, whatever name called, that offers services or facilities requiring diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognised system of medicines in India, or a place established as an independent entity or a part of an establishment to carry out diagnostic or investigative services of diseases;

“authorised medical practitioner” means a medical practitioner registered with any of the councils of the recognised system of medicines established or recognised by law in India and includes a medical professional having the requisite qualification to practice in any recognised system of medicines in India as per any law for the time being in force;

The client is found to be engaged in providing services to its inmates which is against a fees, comprises inter alia of care manager visit for medical checkup, general physician home visit and home delivery of medicine. The aforesaid services may get covered under health care services as defined in Para 2 (zg) of Notification No. 12/2017 Central Tax (Rate) dated 28.06.2017. However, supply by way of health care services qualifies for exemption under serial number 74 of Notification No. 12/2017 Central Tax (Rate) dated 28.06.2017 if the same is provided by a clinical establishment, an authorised medical practitioner or para-medics.

Admittedly, the applicant doesn’t fall under any of the aforesaid categories of suppliers and the services provided by the applicant, therefore, fail to qualify as exempted service.

Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 – Levy.

According to Serial number 7(ii) Heading 9963 of Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 as amended from time to time, services rendered by all the old age homes were taxable under GST as included in the description that, “Services by a hotel, inn, guesthouse, club or campsite, by whatever name called, for residential or lodging purposes”, having declared tariff of a unit of accommodation of ₹ 1000 and above per day @ 18 % ( CGST @ 9 % + SGST @ 9 %). Hence hostels, old age homes, working women hostels, hotels, clubs, guest houses etc. if they charge below ₹1000.00 per day for lodging (accommodation) only, then they were free from GST.

According to Serial number 31 Heading 9993 of Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 as amended from time to time, services rendered by all the old age homes were taxable under GST as included in the description that, “Human health and social care services.” @ 18 % (CGST @ 9 % + SGST @ 9 %).

Notification No. 14/2018-Central Tax (Rate) dated 26.07.2018.

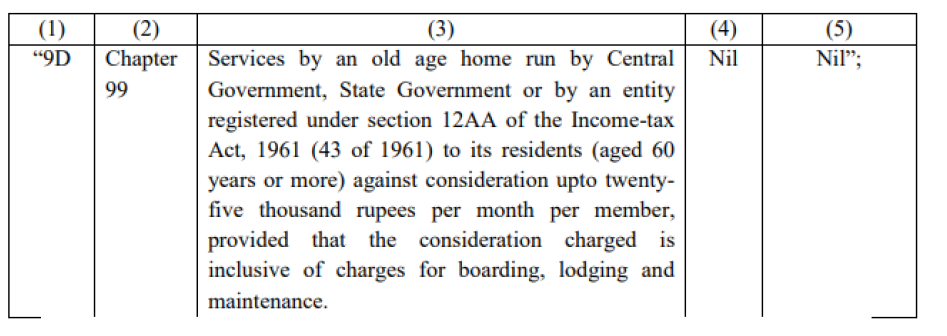

The recommendations of the GST Council, hereby makes the following further amendments in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), No.12/2017- Central Tax (Rate), dated the 28thJune, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 691(E), dated the 28th June, 2017, namely after serial number 9C and the entries relating thereto, the following serial number and entries shall be inserted, namely: –

Points to be noted.

Regular medical monitoring to senior citizens is taxable @ 18% / Elderly-care programmes requiring a subscription is taxable @ 18%.

The West Bengal Authority for Advance Ruling (AAR) in the case of Snehador Social & Health Care Support LLP vide Order No. 18/WBAAR/2022-23 dated 22.12.2022, has ruled that services of regular medical monitoring, along with other logistical support, provided by the applicant service provider to senior citizens at their doorsteps, attract 18% GST. It is ruled that the same does not qualify for exemption but is liable to tax @ 18% vide serial number 31, Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 (Heading 9993 – Human health and social care services), as amended.

M/s Snehador Social & Health Care Support, a startup entity offers three subscription packages for senior citizens to choose from based on their needs. Senior citizens subscribers must incur an annual registration fee, a quarterly subscription fee and an upfront deposit that is refundable. The issue lies in identifying the nature of services the startup provides to senior citizens, whether it is ‘health care’ or ‘human health and social care’ services. The former is tax-exempt, whereas the latter is taxable at 18% GST.

Facts of the case

As per Sl.No 74 of Notification No. 12/2017-Central Tax (Rate) exempts services by way of health care services subject to conditions.

As per Sl.No 7(ii) Heading 9963 and / or Sl.No. 31 Heading 9993 of Notification No. 11/2017-Central Tax (Rate) services rendered by all the old age homes were taxable @ 18% % ( CGST @ 9 % + SGST @ 9 %).

As per Sl.No 9D (inserted) in Notification No. 14/2018-Central Tax (Rate) Services by an old age home exempt from GST subject to conditions.

To address the points mentioned:

- Formation of Trust under The Indian Trusts Act, 1882 for “Old Age Home”:

- Gather a group of individuals who share the vision of establishing an old age home.

- Draft a trust deed outlining the objectives, governance structure, and operational guidelines in accordance with The Indian Trusts Act, 1882.

- Specify the objectives of the trust, which in this case would be to provide care, support, and accommodation to elderly individuals.

- Ensure compliance with all legal requirements and formalities for the formation of the trust.

- Filing FORM 10A to Commissioner of Income Tax (Exemption) for getting approval u/s 12AA of Income Tax Act, 1961:

- Prepare and submit Form 10A along with the necessary documents to the Commissioner of Income Tax (Exemption).

- Ensure that the trust deed, along with the objectives mentioned therein, complies with the requirements of Section 12AA of the Income Tax Act, 1961.

- Await approval from the Commissioner of Income Tax (Exemption) for tax exemption under Section 12AA.

- Admission for inmates aged 60 years or more only:

- Establish admission criteria specifying that only individuals aged 60 years or above are eligible for admission.

- Ensure that the admission process complies with all relevant laws and regulations, including those related to discrimination and eldercare.

- Fees not more than Rs.25,000/- per month per member:

- Determine a fee structure that does not exceed Rs. 25,000 per month per member.

- Clearly outline the fee structure in the trust deed or operational guidelines.

- Ensure transparency in fee collection and usage.

- The consideration charged is inclusive of charges for boarding, lodging, and maintenance:

- Clearly specify in the trust deed or agreements with members that the fees charged cover expenses for boarding, lodging, and maintenance.

- Provide transparent accounting of how the fees are utilized for the benefit of the residents.

Overall, ensure that all actions taken are in compliance with relevant laws and regulations, and prioritize the well-being and care of the elderly residents of the old age home.

Disclaimer: The opinion is for information purposes only and does not constitute advice or a legal opinion. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability.