Goods and Services Tax in Singapore

This article deliberates on Goods and Services Tax or GST, a broad-based consumption tax levied on import of goods (collected by Singapore Customs), and also on supplies of goods and services in Singapore. GST is also known as Value-Added Tax or VAT In many other countries. Inland Revenue Authority of Singapore (IRAS) is the tax administrator and acts as the agent of the Government of Singapore. Singapore’s GST system is referred to and applauded by experts around the world.

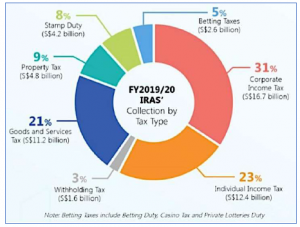

Before we commence to discuss about the concept, applicability and procedure of GST in Singapore, lets first understand different kind of taxes which contributes to revenue generation for Singapore Government. In Singapore, Direct and Indirect tax revenue in total contributed to approximately 72% of the Government’s operating revenue (FY 2019/20). Taxes that fall within the ambit of Direct and Indirect taxes through which government revenue is generated include Income tax, GST, Property Tax, Stamp Duty, Betting Tax etc.

From the chart, we can see that in the Financial Year 2019-20 approximately 21% (SGD 11.2 billion) of the Inland Revenue Authority of Singapore (IRAS) revenue collection is from GST and it is one of the top 3 contributors in Singapore Government’s revenue collection from direct and indirect taxes. GST is a multi-stage tax levied on supplies of goods and services. It is charged by a business each time the business sells a product or service to another business or an individual within the territory of Singapore. Singapore has only one tax rate under GST at one point in time.

2019-20 approximately 21% (SGD 11.2 billion) of the Inland Revenue Authority of Singapore (IRAS) revenue collection is from GST and it is one of the top 3 contributors in Singapore Government’s revenue collection from direct and indirect taxes. GST is a multi-stage tax levied on supplies of goods and services. It is charged by a business each time the business sells a product or service to another business or an individual within the territory of Singapore. Singapore has only one tax rate under GST at one point in time.

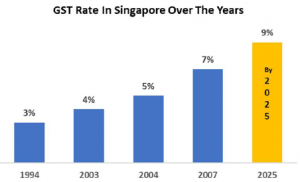

GST was introduced in Singapore in the year 1994 @ 3% which was gradually increased to 4% in 2003, 5% in 2004 and 7% in 2007. The Government had announced in the Budget of 2018 that the standard rate will be raised from 7% to 9%, between 2021 to 2025. However, after reviewing national revenue and expenditure projections, and considering the current state of the economy, the Government has decided that the GST rate increase will not take effect in 2021 but the same will be implemented by 2025.

Deputy Prime Minister Heng Swee Keat in a speech to round up the debate on the Government’s Covid-19 strategy said that “We will continue to study the timing of increasing the GST rate carefully, taking into account the pace of our economic recovery, our revenue outlook and how much spending we can defer to later years without jeopardising our long-term needs”.

Covid-19 has impacted economies the world over and Singapore is no exception. Because of travel restrictions and Circuit Breaker measures in the country, GST collections this year is significantly lower (from SGD 11.2 billion in FY2019 to SGD 9.9 billion in FY2020 – Source: https://www.channelnewsasia.com/news – Feb 21) due to the pandemic’s dampening effect on consumption. The Government is also of the view that in case GST is not raised over the next 2-3 years, it will be on a “tight leash” when it comes to fiscal spending. It may lead to deferment of infrastructure projects and stretching of fiscal resources.

As per Goods and Services Act: “A tax to be known as Goods and Services Tax shall be charged in accordance with the provisions of this Act on the supply of goods and services (including anything treated as such a supply) and on the importation of goods”.

All supply of goods and services in Singapore are taxable transactions unless they are exempted.

The following points need to be considered for GST:

- Taxable supply is either a Good or a Service. Goods are usually tangible products and services are simply defined as any action done for a consideration.

- Supply should be in Singapore. Goods will be regarded as supplied in Singapore if the goods are in Singapore at the time of supply. Services are considered supplied in Singapore if the person who is serving belongs to Singapore.

- Time of supply for both goods and services will be earlier of issue of invoice vs receipt of payment.

- Value of the supply is amount on which GST is charged. Value of supply if is not for consideration in money then it will be open market value.

GST application and procedures are conceptually quite similar to other countries; however, the specifics relating to Singapore GST are highlighted below:

1. REGISTRATION: The first step is to evaluate whether the business entity needs to get itself registered as a GST registered undertaking. GST is a self-assessed tax and businesses are required to continually assess whether there is a need to be registered, based on the provisions of the law. GST registration falls into two categories: Compulsory and Voluntary. A business must compulsorily register for GST if:

- Taxable turnover at the end of any calendar year on or after 1 Jan 2019 is more than SGD1 million#.

- If at any time, it is reasonably expected that the taxable turnover in the next 12 months to be more than SGD1 million. To substantiate the expected number to reach taxable turnover, businesses should have proper supporting documents in place.

If the business is not supposed to go for compulsory GST registration, it may still choose to do so voluntarily after careful consideration. The benefit of doing so is that it can get input tax credit that it has paid to its GST registered suppliers. However, there will definitely be an increase of cost due to reporting and the compliance requirements. So, it is prudent for companies opting for voluntary GST registration to do a cost-benefit analysis.

With effect from 1st January 2020, in case of non-registered businesses that are not entitled to full input tax credit will also have to register for GST to account for the reverse charge if the value of the imported services exceeds SGD1 million in a 12-month period.

Companies will be required to apply for GST within 30 days from the date the company falls under the above conditions. In case of late registration, IRAS may impose a fine up to SGD10,000 & a penalty of 10% of the GST due. Prosecution action may apply too.

Business can be exempted from compulsory registration if it only makes zero-rated supplies, even though the total taxable turnover exceeds the SGD 1 million.

# Before Jan 2019, a business was liable to be registered if at the end of any quarter the last day of which is a day before 1st January 2019, if the total value of the taxable supplies made in Singapore in that quarter and the 3 quarters immediately preceding that quarter has exceeded SGD1 million.

Above registration procedure covers in general for all entities. However, law provides guidance with respect to some specific entities which are as under:

- Overseas Entities: A non-resident entity that does not have a fixed business establishment in Singapore can also register for GST as per the above procedure. However, it has to appoint a local agent in Singapore to fulfill its GST obligations.

- Overseas Suppliers and Overseas Electronic Marketplaces: Overseas Suppliers and Overseas Electronic

Marketplaces registering for GST under Overseas Vendor Registration Regime (OVR) can register directly with IRAS and they are not required to appoint a local agent. However, in case of voluntarily registration they are required to provide a security deposit. - Joint Ventures (JV): In case the JV is an ACRA registered legal entity, it can be registered for GST as above. In case it is not, it can only be registered for GST if it is a distinct, organised entity with documentary evidence governing the constitution, objects, rules and activities.

- Partnerships: Above JV rules apply to partnerships too.

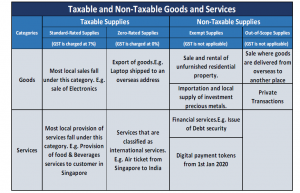

2. APPLICABILITY: GST is levied on the supply of goods and services within the country including import of goods. It is not applicable to all kinds of supplies. Taxable supplies are Standard Rated Supplies and Zero-Rated Supplies. Non-taxable supplies are Exempt supplies and Out of Scope Supplies. The table below lists the categories and types of taxable and non-taxable supplies.

Before 1st January 2020, the services procured from local suppliers were subject to GST but services procured from overseas suppliers were not subjected to GST. To make it at par, with effect from 1st Jan 2020, IRAS introduced the concept of Reverse GST which are:

Before 1st January 2020, the services procured from local suppliers were subject to GST but services procured from overseas suppliers were not subjected to GST. To make it at par, with effect from 1st Jan 2020, IRAS introduced the concept of Reverse GST which are:

ο Reverse Charge (RC) mechanism

ο Overseas Vendor Registration (OVR) regime to tax digital services imported by non-GST registered persons (including private individuals)

Under the Reverse Charge regime:

- The recipient of the services will account for GST on the services he imports as if he was the supplier.

- He may claim GST as his input tax, subject to normal input tax recovery rules.

If a GST registered business procures services from overseas suppliers, then it will be subject to RC if:

- The business is not entitled to claim input tax credit in full (i.e., engaged in taxable supplies and exempt

- supplies as well or carrying out non-business activities)

- Belongs to a GST group that is not entitled to claim input tax credit in full.

-

-

If a non-GST registered business procures services from overseas suppliers, then it would be liable for GST registration by virtue of RC if the business satisfies the below conditions:

- The value of imported services which are within the scope of reverse charge exceed SGD 1 million in 12 months period.

- The business is not entitled to claim GST credit in full.

-

-

All imported services are covered under RC mechanism except the supplies which are specifically exempted under GST Act.

Under Overseas Vendor Registration regime, an overseas company is liable for GST registration in Singapore if:

- Annual global turnover exceeding SGD1 million and

- Their B2C suppliers of digital services to customers in Singapore exceeds SGD 100,000.

-

-

Under the OVR regime, supplies of digital services to consumers (i.e., individuals and non-GST registered businesses) are subject to GST. A GST-registered overseas service provider will thus have to determine if a customer is GST-registered to charge GST correctly.

3. RESPONSIBILITIES OF GST REGISTERED BUSINESS: In case a business is GST registered it needs to fulfil the following responsibilities:

- Once a business is GST registered, it must charge GST on all taxable supplies which is Output Tax. Any GST which the business incurs on purchases and expenses (including import of goods) is known as Input Tax. The net tax is either paid or received from the authorities.

- It should file GST returns either on a monthly or quarterly basis as it has opted at the time of registration. Nil return should be filed in case of nil transaction. Failure to e-File is an offence, punishable with a fine up to SGD5,000 and in default of payment, an imprisonment term up to six months.

- Within one month after filing the GST return, it must pay GST to IRAS. For non/late payment, a 5% penalty will be levied on the amount of tax unpaid by the due date. An additional penalty may also be imposed.

- It must keep proper business and accounting records for at least five years to support GST declarations.

- It must display and quote prices inclusive of GST.

- It must always issue Tax Invoices with GST registration number.

- It must notify IRAS of any changes in the business name, address, financial year-end, principal activity,

etc. -

-

4. VARIOUS SCHEMES UNDER GST: Some of the schemes introduced by the Government of Singapore to ease cash flow for businesses and to create a pro-business environment are listed below:

- Discounted Sale Price Scheme allows to charge 50% GST of the selling price on a second-hand / used vehicle. No prior permission is needed from IRAS for this treatment.

- Gross Margin Scheme in which GST is chargeable only on the gross margin of the goods.

- Hand-Carried Exports Scheme is applicable when a business wish to zero-rate the supply made to an overseas customer and the goods are hand-carried out of Singapore via Changi International Airport.

- Import GST Deferment Scheme wherein GST can be paid on imports when the monthly GST returns are due instead of at the point of importation.

- Major Exporter Scheme is designed to ease the cash flow of major exporters who have significant imports.

- Tourist refund scheme allows tourists who buy goods in Singapore from participating GST registered retailers to claim a refund of the GST paid if the goods are brought out of Singapore.

- Cash Accounting Scheme is for small businesses whose annual sales do not exceed SGD 1 million.

- Zero GST Warehouse Scheme is administered by Singapore Customs. Under this scheme, import GST on non-dutiable overseas goods is suspended when the goods are moved into a Zero GST G warehouse. GST is payable only when the imported goods leave the warehouse and enter the local market.

-

-

5. CANCELLATION OF GST REGISTRATION: GST registration must be cancelled within 30 days when:

- Business stops making taxable supplies and do not intend to make taxable supplies in future;

- Business has been ceased;

- Business is transferred as a whole to another person.

- Business constitution has changed (e.g., sole-proprietorship business converted to a partnership etc.).

- However, if a business was previously registered under a voluntary basis, it is required to remain registered for at least 2 years before cancellation.

-

-

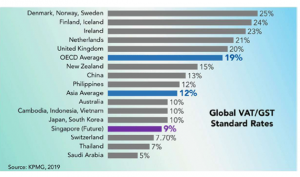

GST in Singapore, is considered to be one of the best practices in the world. Singapore has only one tax rate under GST while many other countries have multiple slabs including India. The GST rate in Singapore is one of the lowest in the world even if the rate is increased to the proposed 9% from the current rate of 7% (see comparative chart on the right).

Comparing GST regime in India with Singapore several experts were quoted citing examples of Singapore and how India should also do away with multiple tax slabs under the Goods and Services Tax for greater ease of compliance (The Economic Times in 2019). Similar statements have also been made by other experts (Business Standard in 2019), wherein it was suggested Singapore GST model should be implemented to ensure proper compliances in India. Singapore also topped in the research conducted by UNSW Sydney and KPMG, that considered the compliance requirements and administrative burden associated with adhering to Value Added Tax (VAT) and Goods and Services Tax (GST) rules. Although it’s early days for the new provisions introduced viz. Reverse Charge and Overseas Vendor Registration, in my opinion it has added some complexity to the applicability of the law. Nevertheless, Singapore GST compliance requirements are still one of the best in the world.