Bahrain VAT Regime – New but Uncomplicated

For years, the Kingdom of Bahrain had been among very few countries to have no significant form of taxation – both personal or corporate whether direct or indirect. All this changed on 1 February 2017 when Bahrain signed the Gulf Cooperation Council’s (GCC) unified agreement to implement Value Added Tax (VAT). Accordingly, Bahrain issued the VAT Law in October 2018 through Decree (48) of 2018 Regarding Value Added Tax and thereafter the Executive Regulations were issued in December 2018.

REGULATOR:

Since there were no taxes in the past, a new regulatory authority, The National Bureau for Revenue (NBR) was set up through Decree No. 45 of 2018. Although, it is new regulator, the NBR has been very approachable and pragmatic in the implementation of the VAT regime. They have been proactive in providing necessary clarifications on open-ended issues under VAT in the form of guides, FAQs and public clarifications. Further, taxpayers can also seek private clarifications by way of an email or lodging a formal tax ruling on the NBR portal. The NBR has also assigned dedicated relationship managers to assist taxpayers on matters relating to topics related to VAT including compliance and advisory among other things.

REGULATION:

- Decree (48) of 2018 Regarding Value Added Tax

- Resolution 12 of 2018 with Executive Regulation of Decree Law 48 of 2018on Value Added Tax

RATE OF TAX

The rate of VAT was fixed at 5% and Bahrain has maintained this rate despite neighboring Saudi Arabia increasing their VAT rates from 5% to 15% effective 1st July 2020.

DATE OF IMPLEMENTATION:

The VAT registration and implementation was carried out in 3 phases

Phase 1: 1st January 2019[businesses with turnover over Bahraini Dinars(BD) 5 million]

Phase 2: 1st July 2019 (businesses with turnover over BD 500,000)

Phase 3: 1st January 2020 (businesses with turnover over BD 37,500)

Voluntary registration is permitted for businesses with turnover of BD 18,750 or above

REGISTRATION PROCESS:

Application for Registration must be made to the NBR within 30 days after end of the month when the annual supplies crosses the mandatory threshold or within 30 days before the month when the value of supplies is expected to exceed the mandatory threshold.

Registration can be done online using the registration form available on the NBR portal along with copies of the relevant documents mentioned therein. Once NBR approves the registration, a unique VAT registration number is generated along with a VAT registration certificate. This has to be included on all VAT invoices, credit notes, and debit notes issued.VAT registration certificate should also be placed in a visible place in the place of business.

BASICS OF OPERATION:

The basic operation of VAT is similar to the standard process of VAT applied globally.

The place of Supply (where tax is ultimately levied) is the jurisdiction where the final consumption occurs and does not necessarily have to be the country where value is created.

VAT becomes due at the earliest of the following

- The date where goods are delivered or made available or performance of service is completed

- The date when any tax invoice is issued in respect of the Supply

- Partial or full receipt of consideration, to the extent of the amount received

For VAT purposes, the value of the Supply includes all other taxes or expenses in respect of that Supply (such as excise tax and customs duties). Where there is a non-monetary consideration involved, the value of supply shall be the total of cash portion and the fair Market Value of the non-monetary portion of the Consideration.

Prices for goods and services supplied to consumers or in retail transactions must be stated as the VAT inclusive amounts

The different categories applied as per the VAT Law are as below:

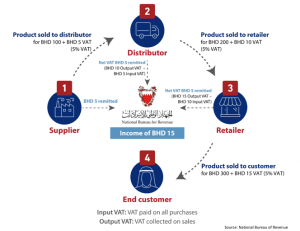

Standard rated items: In case of Bahrain, a standard rate of 5% VAT is applied. The VAT incurred on costs related to standard-rated goods or services can be recovered in full, from the NBR and will not be a cost to the supplier. Some common examples of goods or services that will be subject to VAT at the standard rate of 5% include stationery, office supplies, legal services meals at restaurants, hotels, clothes and cars.VAT is imposed at various phases of the supply chain, which starts from the production to the last phase of final sale of the good or service, as illustrated below:

Zero-rated items: Supplies are subject to VAT, but the VAT rate charged is 0%, but which allows for associated Input VAT to be deducted. Some of the zero rated items are as below:

- Food items listed in the GCC list of basic food items including their imports

- Export of services

- Educational services provided by kindergartens, pre-primary, primary, secondary and higher education institutions

- A number of healthcare services where it is provided by a qualified medical professional or institution.

- Petrol, Diesel, Cooking Gas

- Construction services

- Local transport of goods and passengers in Bahrain such as buses and taxis

- Airplane tickets from one place in Bahrain to a place outside of Bahrain

Exempt items:Goods and services on which no VAT is charged but, in this case, associated Input VAT will not be allowed to be deducted. Examples of extempt items are:

- Interest payments on loans (e.g., credit card, personal loans, mortgages, auto-loans, etc.)

- Currencies trading

- Investment fund services (e.g., issuance of, stocks, bonds and derivatives)

- The issue or transfer of ownership of securities (equities or debt)

- Life insurance and reinsurance contracts

- Interest earnings received on bank deposits

- Sale and rental of real estate

- Import of equipment used by persons with special needs

- Import of personal baggage and used household items

- Import of gifts carried by passengers

Out of scope items: Supplies which are kept out of the ambit of VAT. Some of the examples of out-of-scope items are:

- Educational services provided free of charge at government schools

- Healthcare services provided free of charge at government hospitals

RECORD KEEPING AND REPORTING:

A tax payer must maintain business records that evidence his supplies. These records may be in Arabic or English. The following are examples of records that should be maintained by a tax payer for VAT purposes:

- Accounting books, recording all of transactions in chronological and numerical order

- Records of all supplies (purchases and sales) and imports/exports of goods and services (invoices and import and export declarations)

- Balance sheet and profit and loss accounts

- Contracts and fixed asset records

- Bank statements

NBR is regularly carry out inspections and audits and shall have access to all the above records on demand to examine the VAT due and verify compliance with VAT Law and Regulations.

The Taxable Person must issue the Tax Invoiceno later than the fifteenth day of the month following the month during which the Supply took place. Unlike in Saudi Arabia, it is not mandatory to have the tax invoice in Arabic.

Taxpayers submit self-assessed return with the NBR for a specific Tax Period – monthly in case of businesses with Turnover more than 3 million and quarterly for all other businesses. Due date for payment of tax, claiming refund and for filing tax returns is the end of the month following the end of the tax period i.e due date for the month or quarter ending 31st March will be 30th of April.

If a Taxable Person has not submitted his tax return within the specified period, NBR may estimate the Tax for the Tax Period in respect of which a Tax Return was not submitted, provided that the basis of the NBR’s estimation is determined without prejudice to the criminal responsibility of the Taxable

Person and the administrative fines stipulated in the VAT Law.

TAX AUDIT:

Currently, there is no requirement for a tax audit report from external auditors.

PENALTIES:

Penalties are applied at two levels:

Level one: Articles 60 to 62 of the Executive Regulations provide for administrative fines for violations which is collected with the amount of tax due along with appeals mechanism. Some of the penalties:

- Late submission of a Tax Return or late payment of Tax, within the prescribed period – Minimum of 5% and maximum of 25% of value of tax

- Failure to apply for registration within stipulated time penalty not exceeding BD 10,000

- Submission of false data – Minimum of 2.5% and maximum of 5% of Unpaid tax amount each month

- Obstruction of NBR from implementing provisions of the Law, Failure to show the price of Goods or services inclusive of Tax. Not providing information or data requested by NBR, Failure to comply with the conditions and procedures for issuing a Tax Invoice, Breaching any other provision of the Law or the Regulations – Fine not exceeding BD 5,000

Level two: Articles 63 and 64 provide what is considered as Tax evasion which covers areas such as Registration, Submission, Payment, Deduction, Recovery, False documentation and non-maintenance of relevant Records. The enforcement action which includes imprisonment for a period of not less than three years and not exceeding five years, and by a fine not less than the amount of the Tax due and not exceeding three times the amount of Tax due. The Penalty will shall be doubled if the offence is repeated within three years from the date of final conviction. The Minister of Finance or his authorized delegate, upon the written request of the accused, may approve a reconciliatory approach if an amount equivalent to the minimum fine for the crime as well as the value of the Tax is paid.

Having seen an overview of the VAT regulations in Bahrain, we can now look into some of the practical issues faced by Assesses since the implementation of the new tax regime.

While the process of complying with VAT is quite smooth and streamlined, following are some of the issues faced by taxpayers in Bahrain:

- Taxpayers cannot report negative amount in the ‘adjustments’ column of VAT return – which can arise on account of issue of debit notes, recoverable position during annual wash-up, etc.

- Government entities are not agreeing to pay VAT on top of the contract price on the pretext that supplies made to them are not subject to VAT.

- Registration under VAT cannot be obtained in the absence of a Commercial Registration (CR) – given there is no requirement in this regard under VAT Law. Bahrain with a number of unregistered organisations and associations are not able to register for VAT even if they want to.

- The process of VAT grouping and deregistration from VAT has been found to be cumbersome and time-consuming sometimes.

- The time allowed to respond to NBR audit questionnaire is sometimes short compared to the list of questions asked – which leaves the client juggling between the office work and VAT audits.

- There is still no consensus in the market whether the rounding of VAT amount on the tax invoice is mandatory or optional – given the law states ‘may’ and not ‘shall’.

- Functionality to defer the payment of import VAT has not been enabled yet – which leads to blockage of working capital.

- There is no process of appointment of tax agents by resident taxpayers and tax representatives by non-resident taxpayers.

Further the areas where is lack of clarity in terms of applicability of the provisions of the Law include:

- There is still uncertainty on whether input tax credit can be claimed on medical insurance for employees given there is no legal obligation on the employer to provide this cover.

- There are no guidelines for determining the fair market value of supplies made by holding company to subsidiaries in Bahrain.

- The international transportation of passengers and goods, and certain goods and services provided in respect of the transportation services are zero rated, but companies are still trying to clarify the specifics.

- The supply of services to non-residents is zero-rated in principle, but the interpretation of which services qualify under this rule may differ from company to company.

- Certain pharmacies and supermarkets are still unsure whether some of the items supplied by them actually fall under the zero-rating list – which may lead to disputes at the time of NBR audits.

- Construction sector has experienced lot of complexities and disputes since implementation – in view of multiple tax treatments assigned for supplies made under the projects.

- There are no clear-cut rules for ascertaining the date of supply for supplies account for under reverse charge mechanism – and hence disputes with regard to the date adopted for calculation of CBB exchange rate can arise in future.

- Companies are still in dilemma on whether VAT needs to be accounted on staff deductions and recoveries.

Although some of the issues have been pointed out above, which are just initial teething issues expected to be sorted with some clear instructions, the process of VAT implementation in Bahrain has been quite smooth thanks largely to the single rate of tax in place and small size of the market. Further, since it is early days, there haven’t been many litigations or issues of interpretations of various provisions of the Law. To that extent, the implementation of VAT in Bahrain can be considered highly successful.