Analytical Review

Eligibility and conditions for taking input tax credit

Eligibility and conditions for taking input tax credit can be understood under following sub parts-

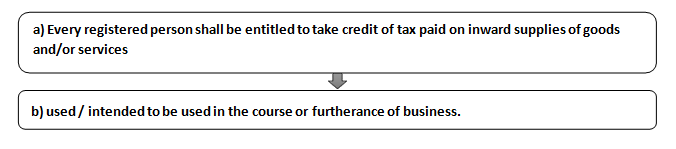

- ELIGIBILITY FOR TAKING ITC U/S 16(1)

Every person registered under the GST Act is entitled to take the credit of input taxes charged on the supply of goods or services or both which are used or to be used in the course or furtherance of business.

The said amount of input tax credit shall be credited to the electronic credit ledger of such person.

The “intention to use” the goods and /or services in the course or furtherance of business would also suffice for availing ITC on such goods and/or services. Thus, tax paid on goods and/or services which are used or intended to be used for non- business purpose cannot be availed as credit.

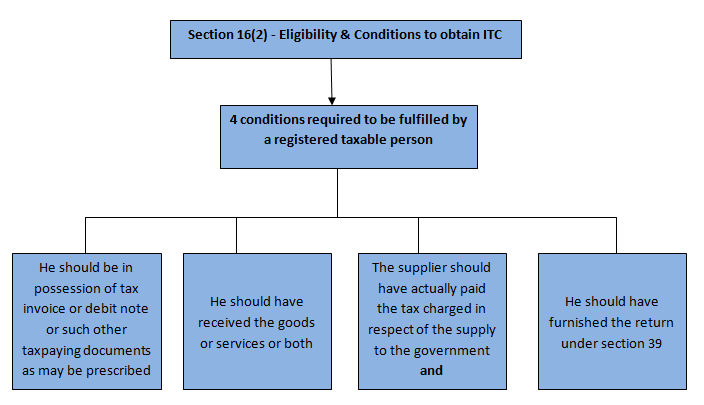

- CONDITIONS FOR TAKING ITC U/S 16(2)

Credit of input taxes shall be available to the registered person only if the following conditions are satisfied:

Condition 1: Possession of Tax Invoice

He is in possession of a tax invoice or a debit note issued by the registered supplier, or such other tax paying documents prescribed. Further, input tax credit shall be available only when the specified particulars are mentioned on the said documents.

Rule 36 of Central Goods and Services Tax Rules, 2017 prescribed documentary requirements and conditions for claiming input tax credit.

- Possession of Tax paying document: The input tax credit shall be availed by a registered person, including the Input Service Distributor, on the basis of any of the following documents, namely;

- An invoice issued by the supplier of goods or services or

- An invoice issued by recipient (receiving goods and/or services from unregistered supplier) along with proof of payment of tax (in case of reverse charge)

- A debit note issued by the supplier

- A bill of entry or any similar document prescribed under the Customs Act, 1962 for the Assessment of Integrated Tax on imports;

- Revised Invoice

- Documents issued by Input Service

- Relevant particulars in the document: The documents on the basis of which ITC is being taken should have all the relevant particulars as prescribed in Rule 46 of the CGST Rules, 2017 relating to a Tax Invoice. This requirement has been relaxed vide Proviso inserted by the Central Goods and Services Tax (Eight Amendment) Rules, 2018, w.e.f. September 4, 2018. The registered person can avail input tax credit if the documents contain the following minimum details-

- Amount of tax charged

- Description of goods or services

- Total value of supply of goods and/or services

- GSTIN of the supplier and recipient

- Place of supply in case of inter-State supply

- No ITC in certain cases: No registered person is permitted to avail any input tax credit in respect of any tax that has been paid in pursuant to an order of demand on account of fraud, willful misstatement, or suppression of fact.

Condition 2: Receipt of goods or services or both

The goods or services or both should have been received by the registered person to be eligible to claim ITC. However, the registered person need not receive the goods or service himself. It is sufficient even if the goods or service are delivered/provided to some other person on his direction.

- In case of bill to-ship to transactions (including where such goods are sent for job work), by which the registered person instructs his supplier to ship the goods to another person on his behalf, the date of receipt of goods by such another person shall be deemed to be the date of receipt of goods by the said registered person.

Hence, it shall be deemed that the taxable person has received the goods where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise.

- Similarly, services may also be provided to a third party by the service provider (supplier) on the direction of the service recipient (registered person). In this case also, though the service recipient does not receive the service, by virtue of explanation to section 16(2)(b) it is deemed that the registered person has received the service.

In other words, service provided by any person on the direction of and on account of the registered person, is deemed to have been received by such registered person. So, ITC will be available to the registered person, on whose direction the service are provided to a third person.

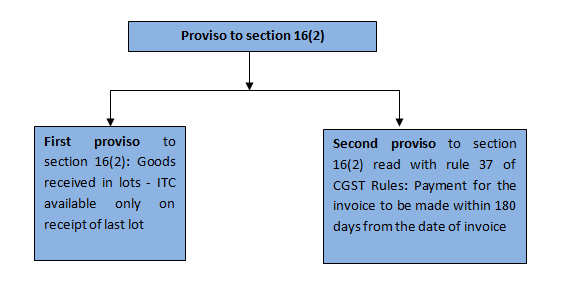

- ITC in case of goods received in lots or instalments

Where the goods against an invoice are received in lots or instalments, the registered person shall be entitled to take the credit upon receipt of last lot or instalment.

Example

Mr. X orders 30000 tonnes of goods which are to be delivered by the supplier via 3 lots of 10000 each. The lots are sent under a single invoice with the first lot and the payment is made by the recipient for Value of Supply plus GST and the supplier has also deposited the tax with the Government.

The 3 lots are supplied in May, June, July 2021. The ITC is available to Mr. X only after the receipt of the 3rd lot. The reason is simple, one of the conditions to avail ITC is the receipt of goods which is completed only after the last lot is delivered.

- Failure to make payment for the invoice within 180 days

Where the recipient of goods and services fails to pay to the supplier (except in case of supplies where tax is payable on reverse charge) the amount of tax towards the value of supply and the tax payable thereon within a period of 180 days from the date of issue of invoice, the amount of credit availed shall be added to his output tax liability along with interest (not exceeding 18%) applicable from the date of availing the credit till the date when the amount is added to the output tax liability.

Further, when the recipient make the payment for invoice along with tax thereon, he shall be entitled to avail the ITC. In case part- payment has been made, proportionate credit would be allowed.

Rule 37 of Central Goods and Services Tax Rules, 2017 prescribed the manner of Reversal of input tax credit in the case of non-payment of consideration

(1) Input tax credit availed on inward supply of goods or service or both to be reversed, where the recipient of goods and services fails to pay to the supplier the amount towards the value of supply and the tax payable thereon within a period of 180 days from the date of issue of invoice. Such supplies will be specified in GSTR-2* of the month immediately following 180 days. (*GSTR-2- filing of GSTR-2 has been deferred)

Exception

This condition of payment of value of supply plus tax within 180 days does not apply in the following situations-

- Supplies on which tax is payable under reverse charge

- Deemed supplies without consideration i.e., supplies made without consideration as specified in Schedule I of the said Act

- Additions made to the value of supplies on account of supplier’s liability as per the provision of Section 15(2)(b), in relation to such supplies being incurred by the recipient of the supply.

Under situation given in point (b) & (c), the value of supply is deemed to have been paid.

(2) Such Input tax credit shall be added in the output tax liability of the said month.

(3) Such addition shall be made along with interest (not exceeding 18%) applicable from the date of availing the credit till the date when the amount is added to the output tax liability.

(4) However, once the payment is made, the recipient will be entitled to avail the credit again without any time limit i.e., the time limit specified in section 16(4) shall not apply to a claim for re-availing of any credit.

If part payment is made within 180 days, then proportionate ITC can be availed.

EXAMPLE:

X Ltd. has purchased goods worth Rs. 1,00,000 [exc. GST @ 18%] on 1st August, 2020. X Ltd. calculated GST @ 18% on 1st August 2020 which came to Rs. 18,000 and correspondingly took credit of the same in the month of September. Owing to bad financial conditions of X Ltd., It failed to pay Rs. 1,18,000 to the supplier. It paid the whole amount in the month of March, 2021. Discuss GST Implementation.

- Date of Invoice = 1st August

- Last date to pay the entire amount = 28th January 2021

- Since X Ltd. has taken credit but not paid the entire amount, credit availed by A Ltd. has to be reversed.

- It will be reversed in FORM GSTR-2/3B and tax has to be paid along with interest.

- Period of interest = from date of taking credit till date when amount added to Output Tax Liability.

- It will be added back in the month of February i.e. the month immediately following the date.

- Upon full payment, X Ltd. Can re-claim credit in the month of March.

Condition 3: Tax charged on supply actually paid to the Government

The tax charged on the goods or services or both have been paid to the Government either through utilization of credit balance available or through cash.

Unmatched Credit Capped At 5 Percent:

As pre provision of rule 36(4) of CGST Rules 2017, If any invoice or debit note is not uploaded by supplier in his GSTR-1 i.e., not in GSTR-2A of recipient of supply, then the ITC for the same invoices or debit note can be claimed to the extent of 5 percent of total eligible credit of taxpayer.

Since the introduction of GST coupled with the Government’s inability to implement GSTR-2/GSTR-3 or the new return system, the assessee at large have been taking undue advantage of the loopholes under the GST Act due to non-implementation of the matching concept wherein details uploaded by the suppliers in GSTR-1 were supposed to be reconciled with the GSTR-2A of the recipient on the basis of which, Input tax Credit was to be availed.

In order to put a stop to the malpractices of the registered taxpayers and to curb the practice of misutilisation of ITC and issue of fake invoices, the Government has introduced Rule 36(4) w.e.f. 09th October 2019 vide notification No. 49/2019, Central Tax providing restrictions on availment of ITC based on uploading of invoices by Supplier.

The said notification has imposed restrictions on the availment of ITC from time to time in a phased manner as follows:

| Notification No. | Additional % of ITC appearing in GSTR-2A | Effective Date |

| 49/2019 dated 09/10/2019 | 20% | 09/10/2019 |

| 75/2019 dated 26/12/2019 | 10% | 01/01/2020 |

| 94/2020 dated 22/12/2020 | 5% | 01/01/2021 |

In simplified form, it could be said that the net eligible ITC that could be availed by a registered person shall be for the invoices appearing in its GSTR-2A and additional 5% (of ITC as per GSTR-2A) for the invoices not appearing in GSTR-2A.

Earlier if GSTR-2A reflected an amount that was less than the amount mentioned in the books of accounts, taxpayer could still claim the ITC as per input tax credit register in GSTR-3B.

Since, the insertion of this rule, the ITC is restricted to the extent of 5% of eligible ITC. That is a registered person can now avail the eligible input tax credit with respect to the invoices or debit notes that are uploaded by its vendor/supplier as reflecting in its GSTR-2A for a particular month. Also, additional 5% of the eligible input tax credit reflecting in its GSTR-2A can be availed with respect to the invoices or debit notes that are not uploaded by its vendor/supplier for a particular month.

Further analysis of Rule 36(4)

What is the significance of 5% of the eligible ITC that can be availed over and above the input tax charged on the invoices uploaded by the supplier?

The additional ITC i.e., the percentage specified (5%) is just a cushion given by the Government assuming that if the businesses were conducted as per the GST provisions, complying with the requirements as specified under the GST Act, that is, all the invoices were being uploaded in GSTR-1 by the suppliers and the availment of ITC was done by the recipient on the basis of invoices being reflected in his GSTR-2A, then there would have been only a few cases where such discrepancy would have prevailed. For such discrepancy, where certain invoices were not being uploaded and wherein the recipient have made bona fide purchases, a limit of 5% of the eligible ITC was given.

What is the meaning of eligible ITC which has to be availed by the recipient and for which the cushion of 5% is given?

In order to calculate the limit of 5%, only those invoices which are eligible for ITC and are reflecting in GSTR-2A have to be considered. In order to maintain uniformity in the calculation of 5%, the basis of invoices as reflected in GSTR-2A which determines eligibility of ITC has been considered.

The clarification states that ‘calculation would be based on only those invoices which are otherwise eligible for ITC’, that is any reversals done post availment of ITC in GSTR-3B i.e., reversal as per Rule 42 & 43 of CGST Rules shall not be deducted from the value of eligible ITC for determining the additional availability of 5% of ITC.

In simplified terms, Eligible Credit would mean:

| Total Input Tax Credit | XXX | |

| Less | Input and input services intended to be used “exclusively” for non-business purposes (T1) | XXX |

| Less | Input and input services intended to be used “exclusively” for making exempted supplies (T2) | XXX |

| Less | Block credit (Section 17(5)) (T3) | XXX |

Further, it has to be noted here that the net eligible input tax credit availed for a month shall be restricted to the eligible input tax credit as appearing in the ITC register in the books of accounts of registered person.

Let us consider the following example:

XYZ is a manufacturing company. For the month of January 2020, it has 50 invoices (for inward supplies) of ITC amounting to Rs. 10 lakhs from various suppliers. But invoices of ITC amounting to Rs. 6 lakhs have been uploaded by suppliers.

| Particulars | Before applicability of Rule 36(4) | After applicability of Rule 36(4) |

| ITC as per invoices of XYZ | 10,00,000 | 10,00,000 |

| ITC as per suppliers (uploaded in GSTR-2A) | 6,00,000 | 6,00,000 |

| Input tax credit not in GSTR-2A | 4,00,000 | 4,00,000 |

| ITC that can be claimed (in respect of Invoice or Debit note not uploaded by supplier) | 4,00,000 | 30,000

(600000*5%) |

| Total ITC that can be claimed in the GSTR-3B | 10,00,000 | 6,30,000 |

| ITC not allowed in the GSTR-3B for the month of January 2020 | Nil | 3,70,000 |

Certain additional points to be considered while mapping ITC register with GSTR-2A as per Rule 36(4):

- The restriction imposed under the said rule has to be self-assessed cumulatively (not supplier wise) by the registered person and shall be applicable only on invoices or debit notes on which credit has been availed on or after 9th October 2019.

- GSTR-2A as available on the due date of filing of return for outward supply in form GSTR-1 shall be considered for the purpose of mapping of GSTR-2A and ITC register (Books of accounts).

For Example, where GSTR-2A for the month of January 2020 reflected ITC amounting to Rs. 15 lakhs as on 11th February 2020 and a particular supplier filed his GSTR-1 on a later date, say on 15th February 2020 wherein an additional ITC of Rs. 3 lakhs was reported by him thus ITC as per GSTR-2A extracted on 15th February 2020 being Rs. 18 lakhs, the GSTR-2A as on due date of GSTR-1 i.e. 11th February 2020 with ITC of Rs. 15 lakhs have to be considered for mapping with the ITC register for the month of January 2020.

Example on practical application of Rule 36(4):

Total ITC for the month of January 2021 – Rs. 110 Lakhs (90 Lakhs Eligible + 20 Lakhs Ineligible). The suppliers uploaded the invoices relating to January 2021 as per following details:

| GSTR-2A month | ITC appearing in GSTR-2A | Eligible ITC in GSTR-2A | Ineligible ITC in GSTR-2A |

| January 2021 | 60 | 45 | 15 |

| February 2021 | 30 | 30 | 0 |

| March 2021 | 20 | 15 | 5 |

| Total | 110 | 90 | 20 |

| GSTR-2A month | Eligible ITC in 2A + 5% of Eligible | Eligibility as per Rule 36(4) | Cumulative ITC availed |

| January 2021 | 47.25 [45+(45*5%)] | 47.25 | 47.2 |

| February 2021 | 31.5 [30+(30*5%)] | 31.5 | 78.75 |

| March 2021 | 15.75 [15+(15*5%)] | 11.25* | 90 |

| Total | 94.50 | 90 | 90 |

*Maximum ITC of Rs. 90 can be availed i.e., eligible credit as per ITC register (Books of accounts) can be availed in GSTR-3B

FAQs in relation to applicability of Rule 36(4):

| Q. | Is it mandatory for the supplier to file GSTR-1 for applicability of Rule 36(4)? |

| A. | As per the provisions of Rule 36(4) it appears that availability of the invoice in GSTR-2A of the taxpayer will be sufficient compliance of the Rule. Therefore, it seems that compliance is not dependent on the supplier filing GSTR-1. |

| Q. | Is the additional ITC (5%) required to be availed head wise i.e., IGST/CGST/SGST? |

| A. | The calculations of restriction and additional ITC availment must be done head wise. |

| Q. | Is it mandatory to have an invoice-wise breakup to avail the additional ITC of 5% under Rule 36(4)? |

| A. | Rule 36(4) provides for adhoc availment of additional 5% of eligible matched credit, hence a proper invoice wise break-up is not necessary. |

| Q. | What would be the amount of input tax credit admissible to the taxpayers for a particular tax period in respect of invoices/debit notes which are not uploaded by the suppliers? |

| A. | Input tax credit to be availed by a taxpayer in respect of invoices or debit notes, the details of which have not been furnished in Form GSTR-1 by the supplier or using the invoice furnishing facility, shall not exceed 5% of the eligible credit available in respect of invoices or debit notes the details of which have been furnished in Form GSTR-1 or using the invoice furnishing facility. |

| Q. | When can the taxpayer avail credit on invoices received from supplier’s filing of GSTR-1? |

| A. | The credit for the invoices uploaded in GSTR-1 of supplier can be availed belatedly in the last month of quarter only if not availed within the limit of additional 5% credit. |

| Q. | Does Form GSTR-2B help in calculation of credit under Rule 36(4)? |

| A. | GSTR-2B is an auto-generated document and may not be very useful in calculation of credit. More importantly it will not reflect the invoices not uploaded by the supplier. |

| Q. | What is the consequence of not following the procedure under Rule 36(4)? |

| A. | Besides, general penalty defined in Section ITC access taken may be recovered along with interest as specified under Section 50 of the CGST Act, 2017 along with penalty under Section 73/74 of the CGST Act, |

No mismatch ITC will be allowed, when Section 16(2) (aa) is notified.:

The Finance Act, 2021, has notified certain changes in CGST Act, 2017 & IGST Act, 2017 in order to curb input credit frauds and safeguard Government revenues.

Section 16 of the CGST Act has been amended via Clause 109 of the Finance Act, 2021, which states the eligibility condition to avail ITC –

As per clause 109, a new clause (aa) to sub-section (2) of the section 16 of the CGST Act has been inserted to provide that input tax credit on invoice or debit note may be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note.

The relevant extract of Finance Act’ 2021 is produced below:

“109. In section 16 of the Central Goods and Services Tax Act, in sub-section (2), after clause (a), the following clause shall be inserted, namely: ––

“(aa) the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37;”

Conclusion

Through this amendment one more additional condition has been added for determining the eligibility of ITC. ITC would not be available to the recipient, if the detail of such invoice or debit note has been not furnished by the supplier in GSTR-1 and hence not being reflected in recipient’s GSTR-2A/GSTR-2B. Hence, this amendment gives statutory backing to much disputed and deliberated upon Rule 36(4) of the CGST Rules, 2017.

This amendment shall be applicable from the dated to be notified. Till now, no such date has been notified

Condition 4: Filing of Return

The registered person taking the Input tax credit must have filed his return under section 39.

Other Conditions

- ITC NOT ADMISSIBLE IF DEPRECIATION IS CLAIMED ON TAX COMPONENT AS PER SECTION 16(3)

Where a registered person has claimed depreciation on the tax component of the capital goods and plant and machinery, the input tax credit of such tax component shall not be allowed. Thus in respect of tax paid on such items, dual benefit cannot be claimed under Income Tax Act, 1961 and GST laws simultaneously.

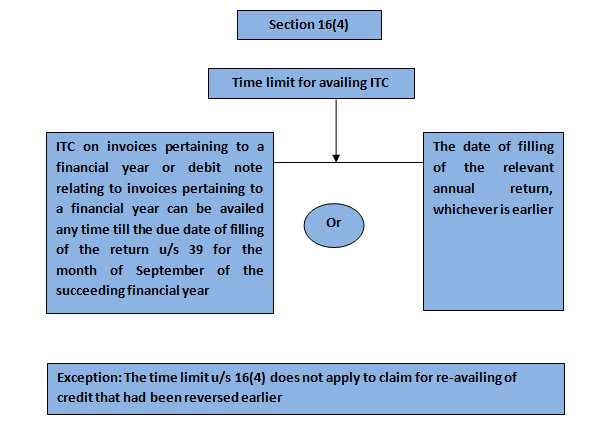

- TIME LIMIT FOR AVAILING ITC U/S 16(4)

The credit of input tax with respect to invoice or debit note issued for supply of goods or services or both can be availed up to-

- the due date of Return to be filed for the month of September following the end of the financial year to which the invoice or debit note pertains or

- the date of furnishing of the annual return,

whichever is earlier.

The above- mentioned time limit shall not apply where earlier reversed credit is re-claimed.

Note: In a financial year, the return for September is to be filed by 20th of October under Section 39 of CGST Act, 2017.

Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019

EXAMPLE:

For an Invoice dated 31st July 2019, the same pertains to the financial year 2019-20.

Hence, the return for the month of September following the end of the financial year to which such invoice relates is due on 20th October, 2020.

Let’s say that the annual return is filed on 12th August, 2020.

The ITC therefore needs to be claimed by 12th August, 2020, which is the earlier of the two dates.

Relevant Case Studies

- Manufacturer of goods chargeable to nil duty, is eligible to avail ITC paid on inputs, which were used in manufacture of goods exported and claim refund

SUPREME COURT OF INDIA in the matter of Commissioner of Central Excise, Chandigarh v. Drish Shoes Ltd referred in 90 taxmann.com 393 (SC) held that a manufacturer who exported final products which were exempt from duty, could claim refund of CENVAT credit of duty paid on inputs and inputs services used in manufacture and export of said wholly exempted final products.

- if it is not within power and control of importer and depends upon acts of other public functionaries, non-compliance of such condition cannot be held to be condition precedent for obtaining benefit

Fact: Exemption is subject to the production of essential certificate from Director General of Hydro carbons at time of importation of goods as per notification no. 121/99-Cus

ONGC had applied for grant of exemption certificate before the Directorate General of Hydrocarbons in the month of April, 1999. The said essentiality certificate, however, could not be produced before the appropriate authority when importation took place as the same had not thence been granted as a result whereof a provisional clearance of the said tapes was made on 6th September, 1999

SUPREME COURT OF INDIA in the matter of Commissioner of Custom (Import), Mumbai v. Tullow India Operation Ltd referred in [2005] 2005 taxmann.com 250 (SC) has find out in para 30 that “the conditions referred to in Sub-section (1) of Section 25 as regard time when such certificate is to be produced would, thus, mean those which were within the control and power of the importer. If it is not within the power and control of the importer and depends upon the acts of other public functionaries, non-compliance of such condition, subject to just exception cannot be held to be a condition precedent which would disable it from obtaining the benefit therefrom for all times to come”.

- Buyer can avail credit even it is not payable or wrongly tax is charged on supply. However, no credit allowed if supplier pay duty on unconditionally exempted goods

High Court of Punjab in the matter of V.G. Steel Industry v. Commissioner of Central Excise reported in [2012] 26 taxman.com 340 (Punjab and Haryana), held that if the duty has been paid in excess of the amount finally held to be payable, unless the excess duty paid has been refunded, the assessee could claim CENVAT credit as the department could not get the duty twice.

High Court of Allahabad in the matter of Commissioner of Central Excise v. Camphor Allied Products reported in [2015] 57 taxman.com 154 (Allahabad) held that amount available as credit is duty actually paid as indicated in removal/sales documents and invoice, even if Central Excise duty has not been passed on fully to buyer of goods and is partly absorbed by seller in some other account.

- Input credit is not allowed where the good are not received

SUPREME COURT OF INDIA in the matter of Excide Industries Ltd. v. Commissioner of Central Goods and Service Tax, Raigad referred in [2019] 105 taxmann.com 192 (SC) held that where the Excise Authorities and the Tribunal have concurrently come to the conclusion that the goods in question were never received by the assessee in its factory and therefore, the assesses claim of having consumed the same was not genuine.

In the matter of HIGH COURT OF GUJARAT in the matter of Mangalam Alloys Ltd. v. Commissioner of Central Excise Ahmedabad-III referred in [2018] 98 taxmann.com 60 (Gujarat) decide where assessee claimed CEVAT credit of duty paid on inputs received under various invoices and Adjudicating Authority denied CENVAT credit for inputs covered under 12 invoices on plea that goods were not physically received by assessee and Tribunal upheld it, since assessee was not able to establish actual movement of goods, order of Tribunal was justified and CENVAT credit, therefore, could not have been claimed

- No credit of shortage receipt of input but shortage due to dryage in transit is allowable/ shortage of stock within tolerance limit

As per Section 16(1) Every registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business. Also, as per Section 16(2) of CGST Act the mandatory condition of availment of input tax credit is that the registered person availing the input tax credit must receive the goods.

There are many reasons for short receipt of inputs like natural cases, difference in weighing, different observing nature of product. In Pre GST many time department has issued the SCN to various assessee for reversal of ITC in case of short receipt of goods. Many petitioners has filed the appeals to the higher authorities against such orders. Court and appellants authorities has taken the view that credit would be availed in case of short receipt of inputs due to natural caused during transits. The ratio of these judgement are very useful to decide that up to what limit of short receipt of input credit is allowed in full. These are discussed below:

Tolerances in respect of hydroscopic, volatile and such other cargo has also to be allowed as per industry norms excluding, however, unreasonable and exorbitant claims. Similarly, minor variations arising due to weighment by different machines will also have to be ignored if such variations are within tolerance limits- CESTAT Chennai, in the matter of Commissioner of Central Excise v. Bhuwalka Steel Industries reported in (2010) 24 STT 436 CHENNAI – CESTAT)(FB) “after considering the argument and case law , considered the view that different types of shortages cannot be dealt with according to any one inflexible and fixed standard for the purpose of allowing credit under rule 3(1) of the CENVAT Credit Rules. Decision to allow or not to allow credit in any particular case will depend on various factors such as the following:—

- Whether the inputs/capital goods have been diverted en-route or the entire quantity with the packing intact has been received and put to the intended use at the recipient factory.

- Whether the impugned goods are hydroscopic in nature or are amenable to transit loss by way of evaporation etc.

- Whether the impugned goods comprise countable number of pieces or packages and whether all such packages and pieces have been received and accounted for at the receiving end.

- Whether the difference in weight in any particular case is on account of weighment on different scales at the dispatch and receiving ends and whether the same is within the tolerance limits with reference to the Standards of Weights and Measures Act, 1976.

- Whether the recipient assessee has claimed compensation for the shortage of goods either from the supplier or from the transporter or the insurer of the cargo.

All these factors listed above, and any other relevant factor has to be kept in view in deciding any particular case as to whether the entire consignment has been received at the end of the recipient assessee without any diversion. Tolerances in respect of hydroscopic, volatile and such other cargo has also to be allowed as per industry norms excluding, however, unreasonable and exorbitant claims. Similarly, minor variations arising due to weighment by different machines will also have to be ignored if such variations are within tolerance limits.”

- In the matter of CCE Bhuwalka Steel Industries (2010) 24 STT 436 = 249 ELT 218 (CESTAT 3 member bench), it has been held that tolerances in respect of hygroscopic, volatile and such other cargo has to be allowed as per industry norms, excluding unreasonable and exorbitant claims. This was followed in CCE v. Somaiya Organo Chemicals (2012) 275 ELT 83 (CESTAT), where it was held that loss of molasses up to 2% in transit and storage is permissible and CENVAT credit is not required to be reversed.

- Assessee cannot be penalized for default of supplier/ Buyer can avail credit even if the supplier has not deposited service tax with Government

As per Section 16(2)(c) the registered person shall be entitled to the credit only when the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilization of input tax credit admissible in respect of the said supply. In other words, in case supplier fails to make the payment of tax the credit would be denied to the recipient even he has paid the tax to the supplier. This condition is subject to Section 41 of CGST Act which provider that the recipient can take the self-assessed ITC on provisional basis. Section 42 and 43 of CGST Act read with Rule 36(2) of CGST Rules, provides for the matching the outward tax declared by the supplier in the GSTR 1 with ITC taken by the recipient in its GSTR 2/GSTR 3B for validating the provisional ITC.

Further, as per clause 109, a new clause (aa) to sub-section (2) of the section 16 of the CGST Act has been inserted to provide that input tax credit on invoice or debit note may be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note. The impact of the same would be that no ITC of inward supply would be allowed, if input supply received from the vendor is not appearing in GSTR 2A/2B. However, the effective date for this amendment is yet to be notified.

In pre-GST period, CENVAT credit rules do not contain such conditions. Further, there are many judgements in which it has been held that credit of the recipient of goods or services cannot be denied even in the case where the duty has not been paid by the supplier of output services. It was many times held by the courts or appellate authorities that buyer cannot be penalized for the default of supplier. These judgements are discussed below:

In a recent judgment, the similar view was taken by the Hon’ble Madras High Court in case of “D.Y. Beathel vs State Tax Officer [(2021) 127 taxmann.com 80 (Madras) [24-02-2021]” wherein it was held that the recipient of supplies has made the payment to the supplier of goods along with the tax amount through banking channels and ITC has been availed based on the returns filed by the supplier. Therefore, the recipient cannot be questioned in case the supplier does any default in the payment of tax to the government exchequer instead the supplier needs to be confronted during the enquiry initiated on the recipient.

In CCE v. Kay Bethel Industries (2013) 42 GST 50 = 38 taxmann.com 336 = 295 ELT 177 (SC), assessee had taken Cenvat credit on basis of proper invoices issued by supplier. It was found that supplier had not paid excise duty collected by him, to Government. Therefore, Department sought to deny Cenvat credit to assessee (user-manufacturer). It was held that when there is a prescribed procedure and that has been duly followed by the manufacturer of final products, we do not perceive any justifiable reason to hold that the assessee-appellant had not taken reasonable care as prescribed in the notification. Due care and caution was taken by the respondent. It is not stated what further care and caution could have been taken. The proviso postulates and requires “reasonable care” and not verification from the department whether the duty stands paid by the manufacturer-seller. When all the conditions precedent have been satisfied, to require the assessee to find out from the departmental authorities about the payment of excise duty on the inputs used in the final product which have been made allowable by the notification would be travelling beyond the notification, and in a way, transgressing the same. This would be practically impossible and would lead to transactions getting delayed. Thus, Cenvat credit cannot be denied to the recipient.

In the matter of Memories Photocopy Studio v. Commissioner of Central Excise, Vadodara-I [2014] 45 taxman.com 237 (Ahmedabad- CESTAT) held that if an assessee makes the payment of the invoices which indicate service tax payable and avails the Cenvat credit, the activity or the action of service provider or not depositing the same in the Government Treasury will not bar the service recipient from taking Cenvat credit on the service tax paid, if eligible.

Delhi High Court delivered a very good judgment in the case of On Quest Merchandising India Pvt. Ltd. v. Government of NCT of Delhi (W.P.(C) 6093/2017 & CM No. 25293/2017) along with other petitions on the admissibility of ITC on bona fide purchases where the sellers have not deposited the tax with the Government. Delhi High Court holds that the expression ”dealer or class of dealers” occurring in Section 9 (2) (g) of the DVAT Act should be interpreted as not including a purchasing dealer who has bona fide entered into purchase transactions with validly registered selling dealers who have issued tax invoices in accordance with Section 50 of the Act where there is no mismatch of the transactions in Annexures 2A and 2B. Unless the expression “dealer or class of dealers” in Section 9 (2) (g) is „read down‟ in the above manner, the entire provision would have to be held to be violative of Article 14 of the Constitution. The result of such reading down would be that the Department is precluded from invoking Section 9 (2) (g) of the DVAT to deny ITC to a purchasing dealer who has bona fide entered into a purchase transaction with a registered selling dealer who has issued a tax invoice reflecting the TIN number. In the event that the selling dealer has failed to deposit the tax collected by him from the purchasing dealer, the remedy for the Department would be to proceed against the defaulting selling dealer to recover such tax and not deny the purchasing dealer the ITC. Where, however, the Department is able to come across material to show that the purchasing dealer and the selling dealer acted in collusion then the Department can proceed under Section 40A of the DVAT Act.

Arise India Ltd. v. CTT [WP(C) 6093 of 2017, dated 26-10-2017], the Delhi High Court – “It can be safely concluded in the present case that there is a singular failure by the legislature to make a distinction between purchasing dealers who have bona fide transacted with the selling dealer by taking all precautions as required by the DVAT Act and those that have not. Therefore, there was need to restrict the denial of ITC only to the selling dealers who had failed to deposit the tax collected by them and not punish bona fide purchasing dealers. The latter cannot be expected to do the impossible. It is trite that a law that is not capable of honest compliance will fail in achieving its objective. If it seeks to visit disobedience with disproportionate consequences to a bona fide purchasing dealer, it will become vulnerable to invalidation on the touchstone of Article 14 of the Constitution”.

After this, Special Leave Petition filed by the Revenue against the above decision. However, the Hon’ble Supreme Court in the case of Commissioner of Trade & Taxes, Delhi and others Vs. Arise India Limited and others [TS-2-SC-2018- VAT], has dismissed the Special Leave Petition filed by the Revenue against the decision of the Hon’ble High Court of Delhi in the case of Arise India Limited and others Vs. Commissioner of Trade & Taxes, Delhi and others [TS- 314-HC-2017(Del)-VAT] (“Arise India case”). The Hon’ble High Court of Delhi held Section 9(2)(g) of Delhi VAT Act to the extent it disallows Input tax credit(“ITC”) to purchaser due to default of selling dealer in depositing tax, as violative of Articles 14 and 19(1)(g) of the Constitution of India.

- Payment of Supplier can be made through book adjustment

In the matter of Senco Gold Ltd., In re [2019] 105 taxmann.com 143 (AAR-West Bengal), it is held that input credit is admissible to the applicant, on debt created on inward supplies from Franchisee, when he settles through book adjustment

In another matter of Arvind Ltd. CCE, Amhedabad-II, [2015] 54 taxman.com 206 (Amhedabad-CESTAT) it is decided that the transfer of the amount of their sister unit by book adjustment would be treated as amount charged to the other unit

- Payment is still required to be made within 180 days when there is supply is made to its own branch in different state

In the matter of Sanghvi Movers Ltd. In re (2020) 113 taxmann.com 24 (AAAR – TN), the case is covered by Schedule I of the CGST Act. The transaction is between distinct persons. The appellant in the tax invoice raised on their customers mentions that the payment to be made either by Cheque/DD in the name of ‘SANGHVI MOVERS LIMITED’ or directly to the account of SML HO at Pune. The appellant has represented that the receipts and payables are accounted at the entity level only. The HO being distinct person in the eyes of law and the transaction is in the course of furtherance of business, the supply is taxable supply for which SML HO has adopted a value agreed under the Tracing clause of the MoU and paid the tax on the value declared in the Invoice. The proviso to rule 37, provides for deemed payment of value in such transactions. Even considering that the said proviso does not have application in the case at hand as there is a value stated in the Tax Invoice as held by the Lower Authority, we find no reason to restrict the Input Tax Credit of the tax paid by the SML HO, in the hands of the appellant as it has been substantially brought out that the ‘consideration’ stands paid to the SML HO either by the customer of the Appellant or by setting off against the payables of the appellant to SML HO, in respect of lease/hire of Cranes, etc. which is as per the established accounting principles. Therefore, we do not find any reason to restrict the eligibility of ITC credit under section 16 (2) of the Act, in the case it was held that branch office is entitled to avail full ITC where payments are netted off against receivables.

- Either seller gave trade discount or price reduction after clearance, full credit is available, so long as duty paid at supplier’s end is not changed.

Where discount was availed by applicant-recipient post supply of goods/services and post issue of invoices, it can avail Input Tax Credit only to extent of invoice value raised by suppliers less discounts i.e. discounted price paid by him to suppliers-Authority of Advance ruling, Tamandu in the matter of MRF Ltd., In re reported in [2019] 103 taxman.com 278 (AAR- Tamil Nadu)-

Para 4.3. “Section 16(1) states that a registered recipient is eligible to take credit on the input tax charged on any supply of goods or services. As per section 9(1), CGST tax is leviable on the value of supply as determined by section 15. Section 15 (3) states that value of supply does not include any discount which is given before or at the time of the supply if such discount has been duly recorded in the invoice issued in respect of such supply and those discounts given after the supply has been effected, if such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices and input tax credit as is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of the supply. Time of supply of goods as per section 12 is the earlier of the following dates, namely the date of issue of invoice by the supplier or the last date on which he is required, under sub-section (1) of section 31, to issue the invoice with respect to the supply or the date on which the supplier receives the payment with respect to the supply”

SUPREME COURT OF INDIA, in the matter of Commissioner of Trade Taxes, Delhi v. Challenger Computer Ltd referred in [2017] 77 taxmann.com 199 (SC) held that Where assessee purchased goods after payment of VAT and received discount from selling dealer subsequent to sales and further claimed ITC on such purchases and entire amount of VAT collected by selling dealer from assessee was deposited to department and HC setting aside orders of lower authorities allowed assessee’s claim for ITC, SLP filed against judgment of HC was liable to be dismissed

CESTAT, Ahmedabad bench in the matter of Commissioner of Central Excise & Custom, Surat-I v. Tirumala Fine Texturiser (P.) Ltd. referred in [2007] 2007 taxman.com 586 (Ahmedabad -CESTAT) held that Credit cannot be denied in case the Credit note issued by the suppliers of the appellant towards trade discount and which did not have any effect on the duty originally paid on such inputs by supplier.

CESTAT, Mumbai bench in the matter of Commissioner of Bajaj Auto Ltd. v. Central Excise & Custom, Aurangabad. referred in [2010] 2 taxman.com 540 (Mumbai -CESTAT) held that Credit cannot be denied in case the Credit of duty actually paid on input invoice and subsequently the price of input is reduced without of being reassessed by the department at manufactured end.

- If assessee wrongly take depreciation on credit portion but on later return revised on realizing mistake, assessee can avail credit.

In the matter of Abhishek Synthetics v. CCE 2005 taxman.com 1462 (Allahabad) High Court of Allahabad, it was decided that the appellant has an option of either taking modvat credit or claiming depreciation. Once an option is exercised, it is not irreversible. The benefit of modvat credit under the Central Excise Rules cannot be denied merely on the ground that depreciation was claimed under the Income Tax in the Income Tax Return of the applicant even when he files the revised income tax return. In case depreciation was claimed on capital goods under Income Tax by mistake, but later revised return was filed on realising the mistake. Once the income tax return is revised, then CENVAT credit become regularized. It was held that CENVAT credit cannot be denied.

However, In the another matter of Philips India Ltd. v. CCE, Vadodara [2010] 3 taxman.com 240 (Allahabad-CESTAT) held in case appellant claimed depreciation is claimed in the income tax return 1996-1997 & 1997-1998 and the Income Tax Returns were filed, assessed and finalized by allowing depreciation. No revised return filed in income tax for above period. In subsequent returns of FY 1999-2000 assessee reversed the depreciation claimed during the years 1996-1997 & 1997-1998. Therefore, the appellants were barred from taking Modvat credit and the fact that they have reversed depreciation is of no use or help to them. Thus, credit not admissible in 1999-2000.

- No right of assessee for seeking directions to GST Authorities to disclose as to whether tenant had taken credit of GST

Assessee let-out its property to a tenant on a monthly rent of Rs. 81,000 and charging GST at rate of 18 per cent on monthly rent in rent bills raised against tenant and depositing same with department. However, tenant had not been paying said tax to assessee. Assessee filed writ petition seeking directions to GST Authorities to disclose as to whether tenant had taken credit of GST amount charged in rent bills. HIGH COURT OF DELHI in the matter of Allied Engineers & Builders (P.) Ltd. v. Muthoot Finance Ltd. referred in [2020] 122 taxmann.com 142 (Delhi) held that the Petitioner is also unable to show any provision of law that puts an obligation on the tax department to furnish the information for which the mandamus is being sought. In case the petitioner has no such legal right, the prayer cannot be granted.